Delta Airlines 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

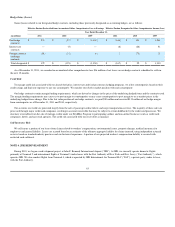

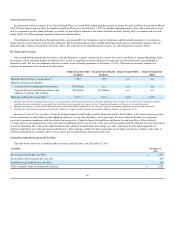

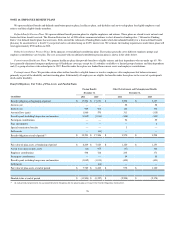

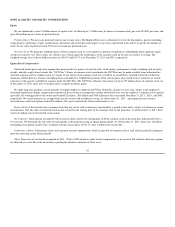

Years Ending December 31,

(in millions) Total

2012 $ 215

2013 530

2014 745

2015 760

2016 760

Thereafter 3,810

Total $ 6,820

During 2011, we entered into an agreement with The Boeing Company to purchase 100 B-737-900ER aircraft with deliveries beginning in 2013 and

continuing through 2018. We have obtained committed long-term financing for a substantial portion of the purchase price of these aircraft.

Our aircraft purchase commitments do not include orders for five A319-100 aircraft and two A320-200 aircraft because we have the right to cancel these

orders.

Contract Carrier Agreements

During the year ended December 31, 2011, we had contract carrier agreements with nine contract carriers, including our wholly-owned subsidiary,

Comair. Our third-party contract carrier agreements have expiration dates ranging from 2016 to 2022.

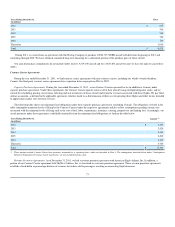

Capacity Purchase Agreements . During the year ended December 31, 2011 , seven Contract Carriers operated for us (in addition to Comair) under

capacity purchase agreements. Under these agreements, the Contract Carriers operate some or all of their aircraft using our flight designator codes, and we

control the scheduling, pricing, reservations, ticketing and seat inventories of those aircraft and retain the revenues associated with those flights. We pay those

airlines an amount, as defined in the applicable agreement, which is based on a determination of their cost of operating those flights and other factors intended

to approximate market rates for those services.

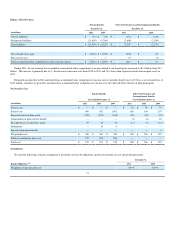

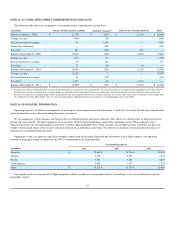

The following table shows our minimum fixed obligations under these capacity purchase agreements (excluding Comair). The obligations set forth in the

table contemplate minimum levels of flying by the Contract Carriers under the respective agreements and also reflect assumptions regarding certain costs

associated with the minimum levels of flying such as the cost of fuel, labor, maintenance, insurance, catering, property tax and landing fees. Accordingly, our

actual payments under these agreements could differ materially from the minimum fixed obligations set forth in the table below.

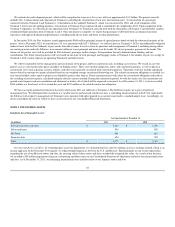

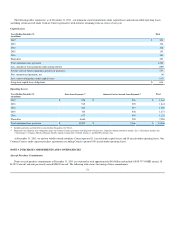

Years Ending December 31,

(in millions) Amount (1)

2012 $ 2,340

2013 2,420

2014 2,430

2015 2,400

2016 2,100

Thereafter 5,700

Total $ 17,390

(1) These amounts exclude Contract Carrier lease payments accounted for as operating leases, which are described in Note 8. The contingencies described below under “Contingencies

Related to Termination of Contract Carrier Agreements” are also excluded from this table.

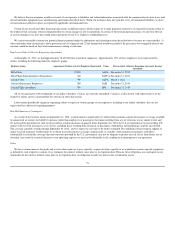

Revenue Proration Agreements. As of December 31, 2011, we had a revenue proration agreement with American Eagle Airlines, Inc. In addition, a

portion of our Contract Carrier agreement with SkyWest Airlines, Inc. is structured as a revenue proration agreement. These revenue proration agreements

establish a fixed dollar or percentage division of revenues for tickets sold to passengers traveling on connecting flight itineraries.

73