Delta Airlines 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

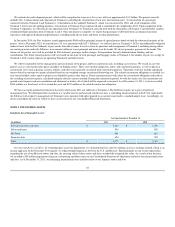

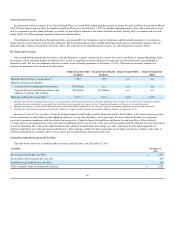

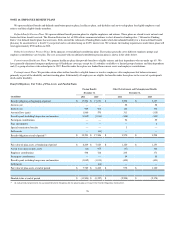

Future Maturities

The following table summarizes scheduled maturities of our debt, including current maturities, at December 31, 2011:

Years Ending December 31,

(in millions) Total Secured and Unsecured Debt Amortization of Debt Discount, net

2012 $ 1,925 $ (199)

2013 1,558 (157)

2014 2,286 (104)

2015 1,347 (75)

2016 1,240 (66)

Thereafter 5,441 (136)

Total $ 13,797 $ (737) $ 13,060

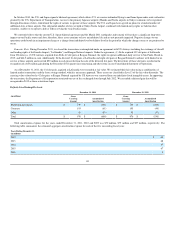

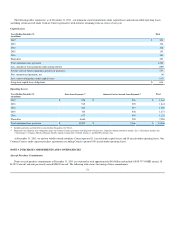

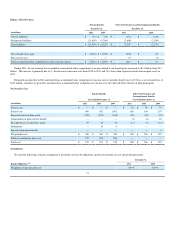

Fair Value of Debt

Market risk associated with our fixed and variable rate long-term debt relates to the potential reduction in fair value and negative impact to future

earnings, respectively, from an increase in interest rates. In the table below, the aggregate fair value of debt was based primarily on reported market values,

recently completed market transactions and estimates based on interest rates, maturities, credit risk and underlying collateral:

December 31,

(in millions) 2011 2010

Total debt at par value $ 13,797 $ 15,442

Unamortized discount, net (737) (935)

Net carrying amount $ 13,060 $ 14,507

Fair value $ 13,600 $ 15,400

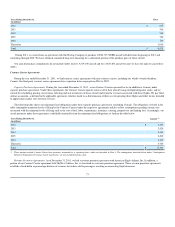

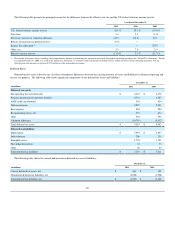

NOTE 8. LEASE OBLIGATIONS

We lease aircraft, airport terminals, maintenance facilities, ticket offices and other property and equipment from third parties. Rental expense for operating

leases, which is recorded on a straight-line basis over the life of the lease term, totaled $1.1 billion, $1.2 billion and $1.3 billion for the years ended

December 31, 2011, 2010 and 2009, respectively. Amounts due under capital leases are recorded as liabilities, while assets acquired under capital leases are

recorded as property and equipment. Amortization of assets recorded under capital leases is included in depreciation and amortization expense. Many of our

aircraft, facility, and equipment leases include rental escalation clauses and/or renewal options. Our leases do not include residual value guarantees and we are

not the primary beneficiary in or have other forms of variable interest with the lessor of the leased assets. As a result, we have not consolidated any of the

entities that lease to us.

71