Delta Airlines 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

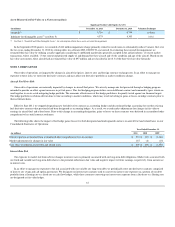

In October 2010, the U.S. and Japan signed a bilateral agreement, which allows U.S. air carriers unlimited flying to and from Japan under route authorities

granted by the U.S. Department of Transportation. Access to the primary Japanese airports (Haneda and Narita airports in Tokyo) continues to be regulated

through allocations of slots, which limit the rights of carriers to operate at these airports. The U.S. and Japan have agreed on plans for a limited number of

additional slots at these airports. The substantial number of slots we hold at Tokyo Narita Airport, combined with limited-entry rights we hold in other

countries, enables us to operate a hub at Tokyo serving the Asia-Pacific region.

We currently believe that the current U.S.-Japan bilateral agreement and the March 2011 earthquake and tsunami will not have a significant long-term

impact on our Pacific routes and slots; therefore, these assets continue to have an indefinite life and are not presently impaired. Negative changes to our

operations could result in an impairment charge or a change from indefinite-lived to definite-lived in the period in which the changes occur or are projected to

occur.

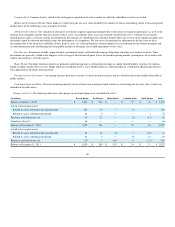

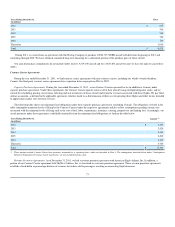

Domestic Slots. During December 2011, we closed the transactions contemplated under an agreement with US Airways including the exchange of takeoff

and landing rights at LaGuardia Airport ("LaGuardia") and Reagan National airports. Under the agreement, (1) Delta acquired 132 slot pairs at LaGuardia

from US Airways, (2) US Airways acquired from Delta 42 slot pairs at Reagan National; the rights to operate additional daily service to São Paulo, Brazil in

2015; and $66.5 million in cash. Additionally, Delta divested 16 slot pairs at LaGuardia and eight slot pairs at Reagan National to airlines with limited or no

service at those airports and received $90 million in cash proceeds from the sale of the divested slot pairs. The divestiture of these slot pairs resulted in the

recognition of a $43 million gain during the December 2011 quarter in restructuring and other items on our Consolidated Statement of Operations.

As of December 31, 2011, the 132 slot pairs acquired at LaGuardia were recorded at fair value. We estimated their fair value using a combination of

limited market transactions and the lease savings method, which is an income approach. These assets are classified in Level 3 of the fair value hierarchy. The

carrying value related to the 42 slot pairs at Reagan National acquired by US Airways was removed from our indefinite-lived intangible assets. In approving

the transaction, the Department of Transportation restricted our use of the exchanged slots through July 2012. We recorded a deferred gain that will be

recognized in 2012 as these restrictions lapse.

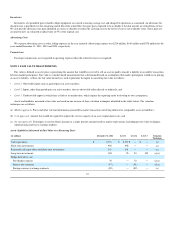

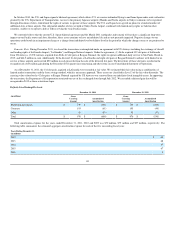

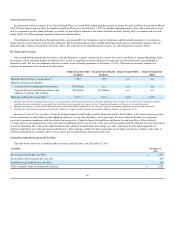

Definite-Lived Intangible Assets

December 31, 2011 December 31, 2010

(in millions) Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Marketing agreements $ 730 $ (486) $ 730 $ (428)

Contracts 193 (61) 193 (49)

Other 53 (53) 53 (53)

Total $ 976 $ (600) $ 976 $ (530)

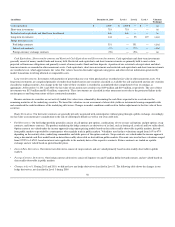

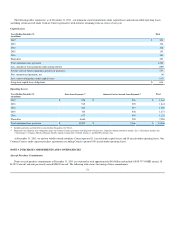

Total amortization expense for the years ended December 31, 2011, 2010 and 2009 was $70 million, $79 million and $97 million, respectively. The

following table summarizes the estimated aggregate amortization expense for each of the five succeeding fiscal years:

Years Ending December 31,

(in millions)

2012 $ 69

2013 68

2014 67

2015 67

2016 9

65