Delta Airlines 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

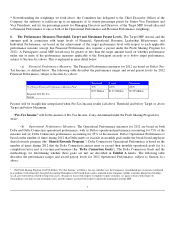

A = Average Operating Income for 2012 and 2013; and

B = Average Invested Capital for 2012 and 2013.

(2) “Average Operating Income” means, subject to Section 4(b)(v)(B) below, Delta's

average annual Total Operating Income over the Performance Period.

(3) “Total Operating Income ” means, subject to Section 4(b)(v)(B) below, Delta's

consolidated operating income for the applicable periods based on its regularly prepared

and publicly available statements of operations prepared in accordance with GAAP, but

excluding: (i) any material asset write downs; and (ii) gains or losses with respect to

unusual or non-recurring events, including, without limitation, changes in accounting

principles, bankruptcy-related reorganization items, restructuring charges, merger-related

costs, extinguishment of debt and other out of period adjustments.

(4) “ Average Invested Capital” means, subject to Section 4(b)(v)(B) below, Delta's total

invested capital averaged monthly over the Performance Period, and shall be calculated

using the following formula, (A+B), where:

A = Market Value of Equity; and

B = Adjusted Net Debt.

(5) “ Market Value of Equity” means the total number of Shares of Common Stock

outstanding on December 30, 2011 multiplied by $8.09 (the closing price of a Share of

Common Stock on the New York Stock Exchange on that date), which value shall remain

constant during the Performance Period; provided, however, in the event that the

Company issues or repurchases additional Common Stock for cash during the

Performance Period (but excluding the exercise of any employee stock option for cash),

the Market Value of Equity shall be adjusted to include the gross cash proceeds of the

equity issuance or exclude the gross cash payments for the equity repurchase, before

adjustment for any applicable fees or charges associated therewith.

(6) “Adjusted Net Debt” for Delta shall be calculated monthly based on its regularly

prepared internal financial statements using the following formula (A+B-C), subject to

Section 4(b)(v)(B), where:

A = Total gross long term debt and capital leases (including current maturities) that reflects Delta's actual

obligations to lenders or lessors, including any adjustments from the book value to reflect premiums or discounts that may

be amortizing;

B = Annual aircraft rent expense multiplied by seven (7); and

C = Unrestricted cash, cash equivalents and short-term investments.

(v) Vesting.

(A) General. Subject to the terms of the 2007 Performance Plan and all other conditions included in any

applicable Award Agreement, the Performance Award shall vest, as described in this Section 4(b)(v), as of the end of the

Performance Period to the extent

6