Delta Airlines 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

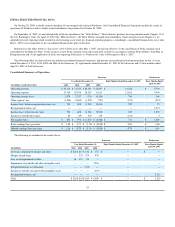

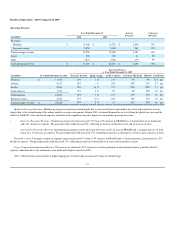

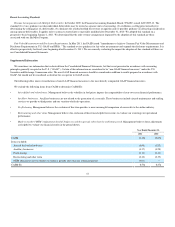

Year Ended December 31,

(in millions) 2011 2010 2009

International and state income tax (provision) benefit $ (7) $ (15) $ 23

Deferred tax benefit 2 — —

Alternative minimum tax refunds and other 90 — —

Intraperiod income tax allocation — — 321

Income tax benefit (provision) $ 85 $ (15) $ 344

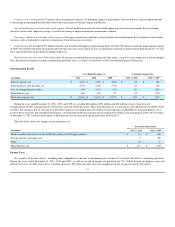

During 2011, we recorded an income tax benefit of $85 million, primarily related to the recognition of alternative minimum tax refunds.

During 2009, we recorded an income tax benefit of $344 million , including a non-cash income tax benefit of $321 million on the loss from continuing

operations, with an offsetting non-cash income tax expense of $321 million on other comprehensive income. This deferred income tax expense of $321

million will remain in accumulated other comprehensive loss until all amounts in accumulated other comprehensive loss that relate to fuel derivatives which

are designated as accounting hedges are recognized in the Consolidated Statement of Operations. All amounts relating to our fuel derivative contracts that

were previously designated as accounting hedges will be recognized by June 2012 (original settlement date of those contracts). As a result, a non-cash income

tax expense of $321 million will be recognized in the June 2012 quarter unless we enter into and designate additional fuel derivative contracts as accounting

hedges prior to June 2012.

At December 31, 2011, we had $16.8 billion of U.S. federal pre-tax net operating loss carryforwards. Accordingly, we believe we will not pay any cash

federal income taxes during the next several years. Our U.S. federal pre-tax net operating loss carryforwards do not begin to expire until 2022.

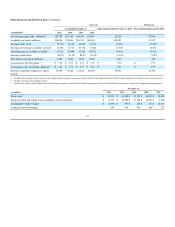

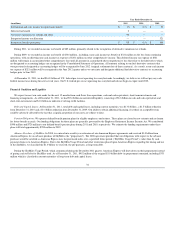

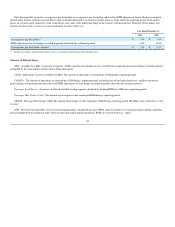

Financial Condition and Liquidity

We expect to meet our cash needs for the next 12 months from cash flows from operations, cash and cash equivalents, short-term investments and

financing arrangements. As of December 31, 2011, we had $5.4 billion in unrestricted liquidity, consisting of $3.6 billion in cash and cash equivalents and

short-term investments and $1.8 billion in undrawn revolving credit facilities.

Debt and Capital Leases. At December 31, 2011 , total debt and capital leases, including current maturities, was $13.8 billion , a $1.5 billion reduction

from December 31, 2010 and a $3.4 billion reduction from December 31, 2009. Our ability to obtain additional financing, if needed, on acceptable terms

could be adversely affected by the fact that a significant portion of our assets are subject to liens.

Pension Obligations. We sponsor defined benefit pension plans for eligible employees and retirees. These plans are closed to new entrants and are frozen

for future benefit accruals. Our funding obligations for these plans are generally governed by the Employee Retirement Income Security Act. We contributed

$598 million and $728 million to our defined benefit pension plans during 2011 and 2010, respectively. We estimate the funding requirements under these

plans will total approximately $700 million in 2012.

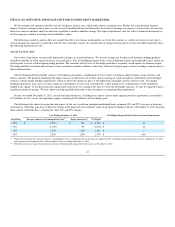

Advance Purchase of SkyMiles. In 2008, we entered into a multi-year extension of our American Express agreements and received $1.0 billion from

American Express for an advance purchase of SkyMiles (the "prepayment"). The 2008 agreement provided that our obligations with respect to the advance

purchase would be satisfied as American Express uses the purchased miles over a specified future period (“SkyMiles Usage Period”), rather than by cash

payments from us to American Express. Due to the SkyMiles Usage Period and other restrictions placed upon American Express regarding the timing and use

of the SkyMiles, we classified the $1.0 billion we received, the pre-payment, as long-term debt.

During the SkyMiles Usage Period, which commenced during the December 2011 quarter, American Express will draw down on their prepayment instead

of paying cash to Delta for SkyMiles used. As of December 31, 2011, $952 million of the original $1.0 billion debt (or prepayment) remained, including $333

million which is classified in current maturities of long-term debt and capital leases.

34