Delta Airlines 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

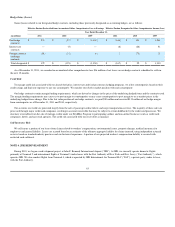

We also have exposure to market risk from adverse changes in interest rates associated with our cash and cash equivalents and benefit plan obligations.

Market risk associated with our cash and cash equivalents relates to the potential decline in interest income from a decrease in interest rates. Pension,

postretirement, postemployment, and worker's compensation obligation risk relates to the potential increase in our future obligations and expenses from a

decrease in interest rates used to discount these obligations.

Foreign Currency Exchange Rate Risk

We are subject to foreign currency exchange rate risk because we have revenue and expense denominated in foreign currencies with our primary

exposures being the Japanese yen and Canadian dollar. To manage exchange rate risk, we execute both our international revenue and expense transactions in

the same foreign currency to the extent practicable. From time to time, we may also enter into foreign currency option and forward contracts. These foreign

currency exchange contracts are designated as cash flow hedges.

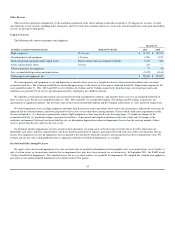

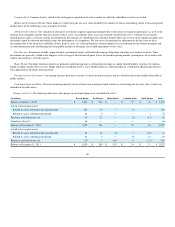

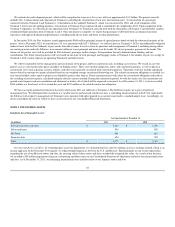

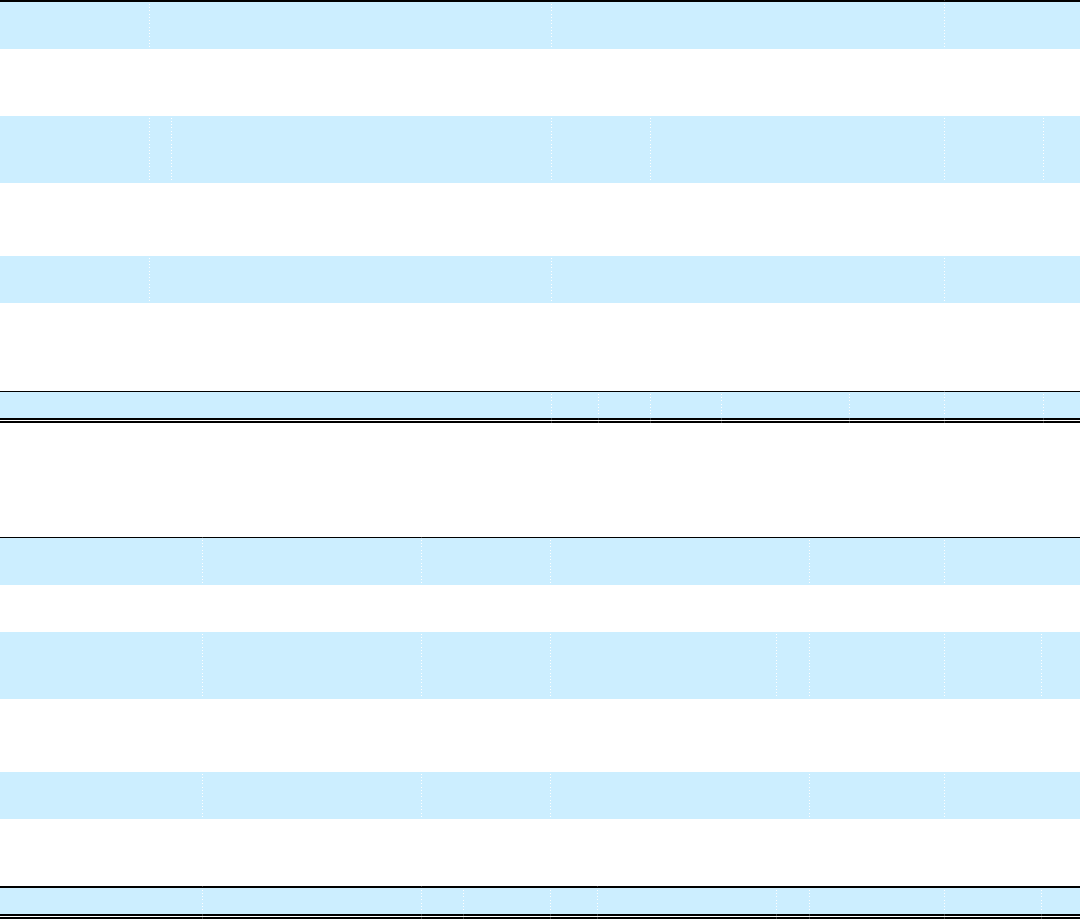

Hedge Position

The following tables reflect the fair value asset (liability) positions, notional balances and maturity dates of our hedge contracts:

As of December 31, 2011:

(in millions) Notional Balance Final Maturity

Date Prepaid Expenses

and Other Assets Other Noncurrent

Assets Other Accrued

Liabilities Other Noncurrent

Liabilities Hedge Derivatives,

net

Designated as

hedges

Interest rate

contracts (cash

flow hedges)

$ 989 U.S. dollars May 2019 $ — $ — $ (27) $ (57) $ (84)

Interest rate

contracts (fair

value hedges)

$ 500 U.S. dollars August 2022 — — — (7) (7)

Foreign currency

exchange

contracts

126,993 Japanese yen April 2014 7 5 (58) (43) (89)

313 Canadian

dollars

Not designated as

hedges

Fuel hedge

contracts

1,225 gallons -

heating oil,

crude oil, and

jet fuel

December

2012

570 — (500) — 70

Total derivative contracts $ 577 $ 5 $ (585) $ (107) $ (110)

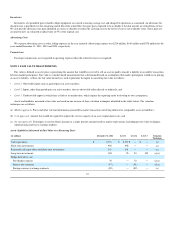

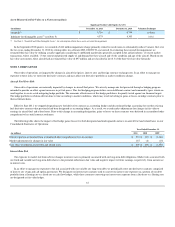

As of December 31, 2010:

(in millions) Notional Balance Final Maturity

Date Prepaid Expenses

and Other Assets Other Noncurrent

Assets Other Accrued

Liabilities Other Noncurrent

Liabilities Hedge Derivatives,

net

Designated as

hedges

Fuel hedge

contracts

1,500 gallons - crude

oil

February 2012 $ 328 $ 24 $ — $ — $ 352

Interest rate

contracts (cash

flow hedges)

$ 1,143 U.S. dollars May 2019 — — (35) (39) (74)

Foreign currency

exchange

contracts

141,100 Japanese yen November

2013

— — (60) (36) (96)

233 Canadian

dollars

Not designated as

hedges

Fuel hedge

contracts

192 gallons - crude

oil and crude

oil products

June 2012 27 14 (19) (8) 14

Total derivative contracts $ 355 $ 38 $ (114) $ (83) $ 196

62