Delta Airlines 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

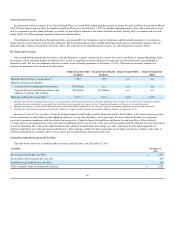

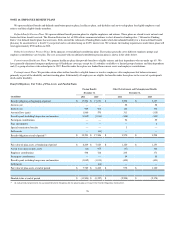

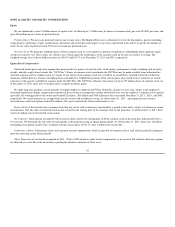

Benefit Payments

Benefit payments in the table below are based on the same assumptions used to measure the related benefit obligations and are paid from both funded

benefit plan trusts and current assets. Actual benefit payments may vary significantly from these estimates. Benefits earned under our pension plans and

certain postemployment benefit plans are expected to be paid from funded benefit plan trusts, while our other postretirement benefits are funded from current

assets.

The following table summarizes, the benefit payments that are scheduled to be paid in the years ending December 31:

(in millions) Pension Benefits Other Postretirement and Postemployment Benefits

2012 $ 1,060 $ 264

2013 1,070 263

2014 1,080 261

2015 1,097 261

2016 1,116 264

2017-2021 5,925 1,394

Other

We also sponsor defined benefit pension plans for eligible employees in certain foreign countries. These plans did not have a material impact on our

Consolidated Financial Statements in any period presented.

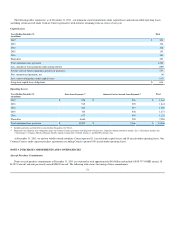

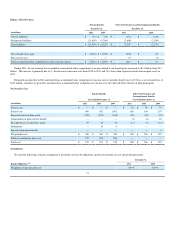

Profit Sharing Program

Our broad based employee profit sharing program provides that, for each year in which we have an annual pre-tax profit, as defined, we will pay a

specified portion of that profit to employees. Based on our pre-tax earnings for the years ended December 31, 2011 and 2010, we accrued $264 million and

$313 million under the profit sharing program, respectively. We did not record an accrual under the profit sharing program in 2009.

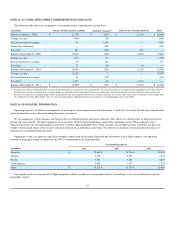

NOTE 11. INCOME TAXES

Income Tax (Provision) Benefit

Our income tax (provision) benefit consisted of

Year Ended December 31,

(in millions) 2011 2010 2009

Current tax (provision) benefit $ 83 $ (7) 15

Deferred tax (provision) benefit (349) (265) 850

Decrease (increase) in valuation allowance 351 257 (521)

Income tax (provision) benefit $ 85 $ (15) $ 344

79