Delta Airlines 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

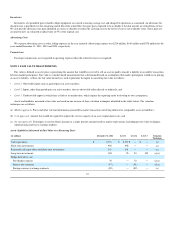

We defer revenue from the mileage credit component of passenger ticket sales and recognize it as passenger revenue when miles are redeemed and

services are provided. We record the portion of the passenger ticket sales for air transportation in air traffic liability and recognize these amounts in passenger

revenue when we provide transportation or when the ticket expires unused. The adoption of ASU 2009-13 did not have a material impact on the timing of

revenue recognition or its classification with regard to passenger tickets earning mileage credits.

Prior to the adoption of ASU 2009-13, we used the residual method for revenue recognition. Under the residual method, we determined the fair value of

the mileage credit component based on prices at which we sold mileage credits to other airlines and then considered the remainder of the amount collected to

be the air transportation deliverable.

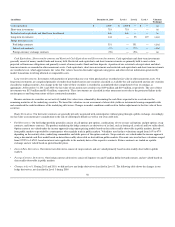

Sale of Mileage Credits. Customers may earn mileage credits through participating companies such as credit card companies, hotels and car rental

agencies with which we have marketing agreements to sell mileage credits. Our contracts to sell mileage credits under these marketing agreements have two

deliverables: (1) the mileage credits redeemable for future travel and (2) the marketing component.

ASU 2009-13 does not apply to contracts to sell mileage credits entered into prior to January 1, 2011 unless those contracts are materially modified. As of

December 31, 2011, we had not materially modified any of our significant agreements. Our most significant contract to sell mileage credits relates to our co-

brand credit card relationship with American Express. For additional information about this relationship, see Note 6. For contracts entered into prior to

January 1, 2011 that have not been materially modified since January 1, 2011, we continue to use the residual method for revenue recognition and value only

the mileage credits. Under the residual method, the portion of the revenue from the mileage component is deferred and recognized as passenger revenue when

miles are redeemed and services are provided. The portion of the revenue received in excess of the fair value of mileage credits sold, the marketing

component, is recognized in income as other revenue when the related marketing services are provided. The fair value of a mileage credit is determined based

on prices at which we sell mileage credits to other airlines and is re-evaluated at least annually.

If we enter into new contracts or materially modify existing contracts to sell mileage credits related to our SkyMiles Program, we will value the

standalone selling price of the marketing component and allocate the revenue from the contract based on the relative selling price of the mileage credits and

the marketing component. A material modification of an existing contract could impact our deferral rate or cause an adjustment to our deferred revenue

balance, which could materially impact our future financial results.

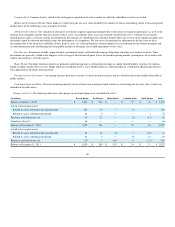

Breakage. For mileage credits which we estimate are not likely to be redeemed (“Breakage”), we recognize the associated value proportionally during the

period in which the remaining mileage credits are expected to be redeemed. The estimate of Breakage is based on historical redemption patterns. A change in

assumptions as to the period over which mileage credits are expected to be redeemed, the actual redemption activity for mileage credits or the estimated fair

value of mileage credits expected to be redeemed could have a material impact on our revenue in the year in which the change occurs and in future years.

Regional Carriers Revenue

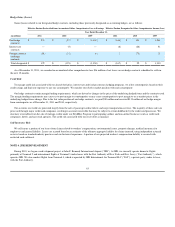

During the year ended December 31, 2011, we had contract carrier agreements with nine Contract Carriers, including our wholly-owned subsidiary,

Comair, Inc. (“Comair”). Our Contract Carrier agreements are structured as either (1) capacity purchase agreements where we purchase all or a portion of the

Contract Carrier's capacity and are responsible for selling the seat inventory we purchase or (2) revenue proration agreements, which are based on a fixed

dollar or percentage division of revenues for tickets sold to passengers traveling on connecting flight itineraries. We record revenue related to all of our

Contract Carrier agreements as regional carriers passenger revenue. We record expenses related to our Contract Carrier agreements, excluding Comair, as

contract carrier arrangements expense.

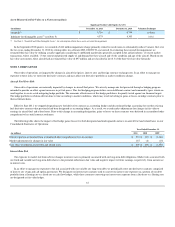

Cargo Revenue

Cargo revenue is recognized when we provide the transportation.

54