Delta Airlines 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

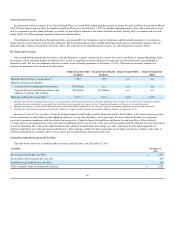

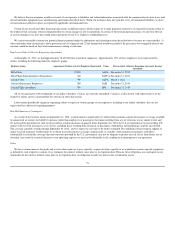

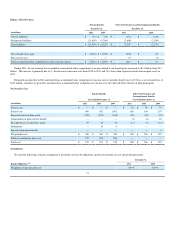

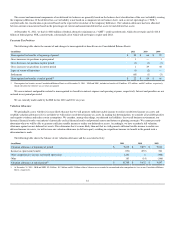

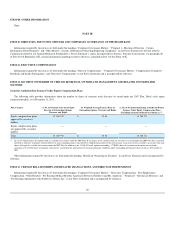

Year Ended December 31,

Net Periodic Cost (2)(4) 2011 2010 2009

Weighted average discount rate - pension benefit 5.70% 5.93% 6.49%

Weighted average discount rate - other postretirement benefit 5.55% 5.75% 6.46%

Weighted average discount rate - other postemployment benefit 5.63% 5.88% 6.50%

Weighted average expected long-term rate of return on plan assets 8.93% 8.82% 8.83%

Assumed healthcare cost trend rate(3) 7.00% 7.50% 8.00%

(1) Our 2011 and 2010 benefit obligations are measured using a mortality table projected to 2015 and 2013, respectively.

(2) Future compensation levels do not impact our frozen defined benefit pension plans or other postretirement plans and impact only a small portion of our other postemployment liability.

(3) Assumed healthcare cost trend rate at December 31, 2011 is assumed to decline gradually to 5.00% by 2020 and remain level thereafter.

(4) Our assumptions reflect various remeasurements of certain portions of our obligations and represent the weighted average of the assumptions used for each measurement date.

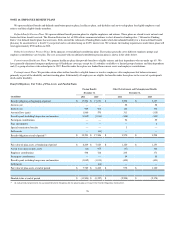

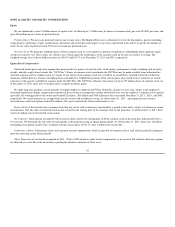

Healthcare Cost Trend Rate. Assumed healthcare cost trend rates have an effect on the amounts reported for the other postretirement benefit plans. A 1%

change in the healthcare cost trend rate used in measuring the accumulated plan benefit obligation for these plans at December 31, 2011, would have the

following effects:

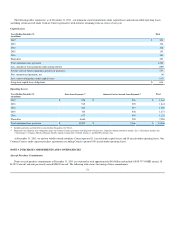

(in millions) 1% Increase 1% Decrease

Increase (decrease) in total service and interest cost $ 5 $ (5)

Increase (decrease) in the accumulated plan benefit obligation $ 63 $ (69)

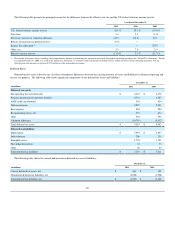

Expected Long-Term Rate of Return. The expected long-term rate of return on plan assets is based primarily on plan-specific investment studies using

historical market return and volatility data. Modest excess return expectations versus some public market indices are incorporated into the return projections

based on the actively managed structure of the investment programs and their records of achieving such returns historically. We also expect to receive a

premium for investing in less liquid private markets. We review our rate of return on plan asset assumptions annually. Our annual investment performance for

one particular year does not, by itself, significantly influence our evaluation. The investment strategy for our defined benefit pension plan assets is to utilize a

diversified mix of global public and private equity portfolios, public and private fixed income portfolios, and private real estate and natural resource

investments to earn a long-term investment return that meets or exceeds our annualized return target.

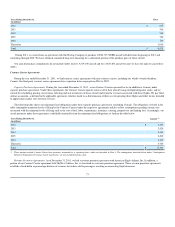

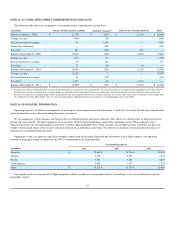

Plan Assets

We have adopted and implemented investment policies for our defined benefit pension plans and disability and survivorship plan for pilots that

incorporate strategic asset allocation mixes intended to best meet the plans' long-term obligations. This asset allocation policy mix utilizes a diversified mix of

investments and is reviewed periodically. The weighted-average target and actual asset allocations for the plans are as follows:

December 31, 2011

Target Actual

Diversified fixed income 22% 23%

Domestic equity securities 21 20

Alternative investments 20 23

Non-U.S. developed equity securities 20 18

Non-U.S. emerging equity securities 6 5

Hedge funds 5 5

Cash equivalents 5 4

High yield fixed income 1 2

Total 100% 100%

The overall asset mix of the portfolios is more heavily weighted in equity-like investments. Active management strategies are utilized where feasible in an

effort to realize investment returns in excess of market indices. For additional information regarding the fair value of pension assets, see Note 2.

78