Delta Airlines 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

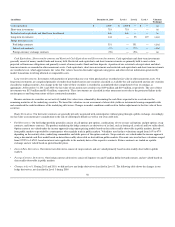

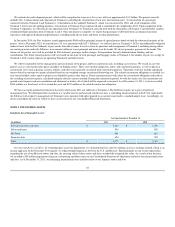

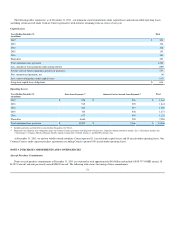

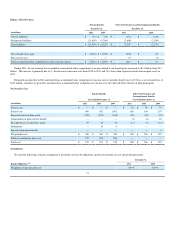

NOTE 7. LONG-TERM DEBT

The following table summarizes our long-term debt:

Interest Rate(s) per Annum December 31,

(in millions) at December 31, 2011 2011 2010

Senior Secured Credit Facilities:

Term Loan Facility, due 2017 5.50% variable (1) $ 1,368 $ —

Revolving Credit Facility, due 2016 undrawn variable (1) — —

Senior Secured Exit Financing Facilities, due 2012 and 2014 n/a — 1,450

Senior Secured Pacific Facilities:

Pacific Routes Term Facility, due 2016 4.25% variable (1) 248 247

Pacific Routes Revolving Facility, due 2013 undrawn variable (1) — —

Senior Secured Notes, due 2014 9.50% fixed 600 675

Senior Second Lien Notes, due 2015 12.25% fixed 306 397

Bank Revolving Credit Facilities, due 2012 undrawn variable (1) — —

Other Secured Financing Arrangements:

Certificates, due in installments from 2012 to 2023 0.92% to 9.75% 4,677 5,310

Aircraft financings, due in installments from 2012 to 2025 (2) 0.86% to 6.76% 4,570 5,170

Other secured financings, due in installments from 2012 to 2031 (3) 2.25% to 6.12% 721 810

Total secured debt 12,490 14,059

American Express - Advance Purchase of SkyMiles (4) 952 1,000

Other unsecured debt, due in installments from 2012 to 2035 3.00% to 9.07% 355 383

Total unsecured debt 1,307 1,383

Total secured and unsecured debt 13,797 15,442

Unamortized discount, net (737) (935)

Total debt 13,060 14,507

Less: current maturities (1,827) (1,954)

Total long-term debt $ 11,233 $ 12,553

(1) Interest rate equal to LIBOR (subject to a floor) or another index rate, in each case plus a specified margin.

(2) Secured by an aggregate of 269 aircraft.

(3) Primarily includes manufacturer term loans secured by spare parts, spare engines and aircraft, and real estate loans.

(4) For additional information about our debt associated with American Express, see Note 6.

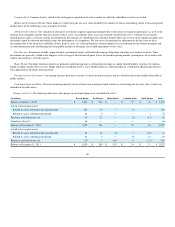

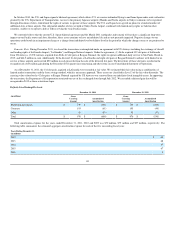

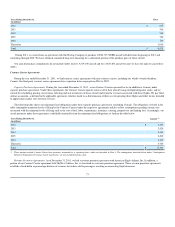

Senior Secured Credit Facilities

In 2011, we entered into senior secured first-lien credit facilities (the “Senior Secured Credit Facilities”) to borrow up to $2.6 billion. The Senior Secured

Credit Facilities consist of a $1.4 billion first-lien term loan facility (the “Term Loan Facility”) and a $1.2 billion first-lien revolving credit facility, up to $500

million of which may be used for the issuance of letters of credit (the “Revolving Credit Facility”).

Borrowings under the Term Loan Facility must be repaid annually in an amount equal to 1% of the original principal amount (to be paid in equal quarterly

installments), with the balance due in April 2017. Borrowings under the Revolving Credit Facility are due in April 2016. At December 31, 2011, the

Revolving Credit Facility was undrawn.

Our obligations under the Senior Secured Credit Facilities are guaranteed by substantially all of our domestic subsidiaries (the “Guarantors”). The Senior

Secured Credit Facilities and the related guarantees are secured by liens on certain of our and the Guarantors' assets, including accounts receivable, inventory,

flight equipment, ground property and equipment, certain non-Pacific international routes, domestic slots, real estate and certain investments (the

“Collateral”).

67