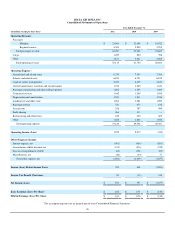

Delta Airlines 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Changes in assumptions or circumstances could result in impairment. Factors which could cause impairment include, but are not limited to, (1) negative

trends in our market capitalization, (2) an increase in fuel prices, (3) declining passenger mile yields, (4) lower passenger demand as a result of the weakened

U.S. and global economy, (5) interruption to our operations due to an employee strike, terrorist attack, or other reasons, (6) changes to the regulatory

environment and (7) consolidation of competitors in the airline industry.

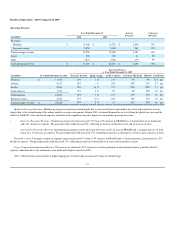

Goodwill. As of December 31, 2011 and 2010 , our goodwill balance was $9.8 billion . In evaluating goodwill for impairment, we estimate the fair value

of our reporting unit by considering market capitalization and other factors if it is more likely than not that the fair value of our reporting unit is less than its

carrying value. If the reporting unit's fair value exceeds its carrying value, no further testing is required. If, however, the reporting unit's carrying value

exceeds its fair value, we then determine the amount of the impairment charge, if any. We recognize an impairment charge if the carrying value of the

reporting unit's goodwill exceeds its estimated fair value.

Identifiable Intangible Assets. Our identifiable intangible assets had a net carrying amount of $4.8 billion at December 31, 2011 . Indefinite-lived assets

are not amortized and consist primarily of routes, slots, the Delta tradename and assets related to SkyTeam. Definite-lived intangible assets consist primarily

of marketing agreements and contracts and are amortized on a straight-line basis or under the undiscounted cash flows method over the estimated economic

life of the respective agreements and contracts.

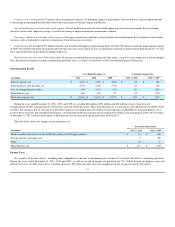

We perform the impairment test for indefinite-lived intangible assets by comparing the asset's fair value to its carrying value. Fair value is estimated based

on (1) recent market transactions, where available, (2) the lease savings method for certain airport slots (which reflects potential lease savings from owning

the slots rather than leasing them from another airline at market rates), (3) the royalty method for the Delta tradename (which assumes hypothetical royalties

generated from using our tradename) or (4) projected discounted future cash flows. We recognize an impairment charge if the asset's carrying value exceeds

its estimated fair value.

Long-Lived Assets

Our flight equipment and other long-lived assets have a recorded value of $20.2 billion at December 31, 2011. This value is based on various factors,

including the assets' estimated useful lives and salvage values. We record impairment losses on flight equipment and other long-lived assets used in operations

when events and circumstances indicate the assets may be impaired and the estimated future cash flows generated by those assets are less than their carrying

amounts. Factors which could cause impairment include, but are not limited to, (1) a decision to permanently remove flight equipment or other long-lived

assets from operations, (2) significant changes in the estimated useful life, (3) significant changes in projected cash flows, (4) permanent and significant

declines in fleet fair values and (5) changes to the regulatory environment. For long-lived assets held for sale, we discontinue depreciation and record

impairment losses when the carrying amount of these assets is greater than the fair value less the cost to sell.

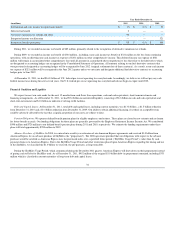

To determine whether impairments exist for aircraft used in operations, we group assets at the fleet-type level (the lowest level for which there are

identifiable cash flows) and then estimate future cash flows based on projections of capacity, passenger mile yield, fuel costs, labor costs and other relevant

factors. If an impairment occurs, the impairment loss recognized is the amount by which the aircraft's carrying amount exceeds its estimated fair value. We

estimate aircraft fair values using published sources, appraisals and bids received from third parties, as available.

Income Tax Valuation Allowance

We periodically assess whether it is more likely than not that we will generate sufficient taxable income to realize our deferred income tax assets and

establish valuation allowances if it is not likely we will realize our deferred income tax assets. In making this determination, we consider all available positive

and negative evidence and make certain assumptions. We consider, among other things, our deferred tax liabilities, the overall business environment, our

historical financial results, our industry's historically cyclical financial results and potential current and future tax planning strategies. We cannot presently

determine when we will be able to generate sufficient taxable income to realize our deferred tax assets. Accordingly, we have recorded a full valuation

allowance totaling $10.7 billion against our net deferred tax assets. If we determine that it is more likely than not that we will generate sufficient taxable

income to realize our deferred income tax assets, we will reverse our valuation allowance (in full or in part), resulting in a significant income tax benefit in the

period such a determination is made.

39