Delta Airlines 2011 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Distribution and Expanded Product Offerings

Our tickets are sold through various distribution channels including telephone reservations, delta.com, global distribution systems and online travel

agencies. An increasing number of our tickets are sold through delta.com, which reduces our distribution costs and gives us closer contact with our customers.

We expect to launch a new delta.com platform in 2012, which we expect will result in additional purchases of tickets through that channel.

We are transforming distribution from a commodity approach to a differentiated and merchandised approach. We expect that the merchandising initiatives

we are implementing, primarily through delta.com, will generate additional revenue opportunities for us and will improve the experience of our customers.

Our plan is to provide our customers with opportunities to purchase what they value, such as first class upgrades, economy comfort seating, WiFi access and

SkyClub passes. We also expect to benefit from increased traffic on delta.com through a combination of advertising revenue and sales of third party

merchandise and services such as car rentals, hotels, and trip insurance.

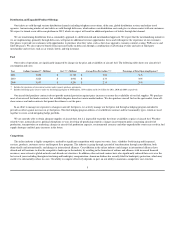

Fuel

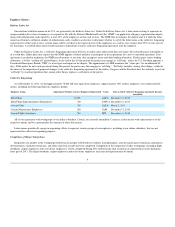

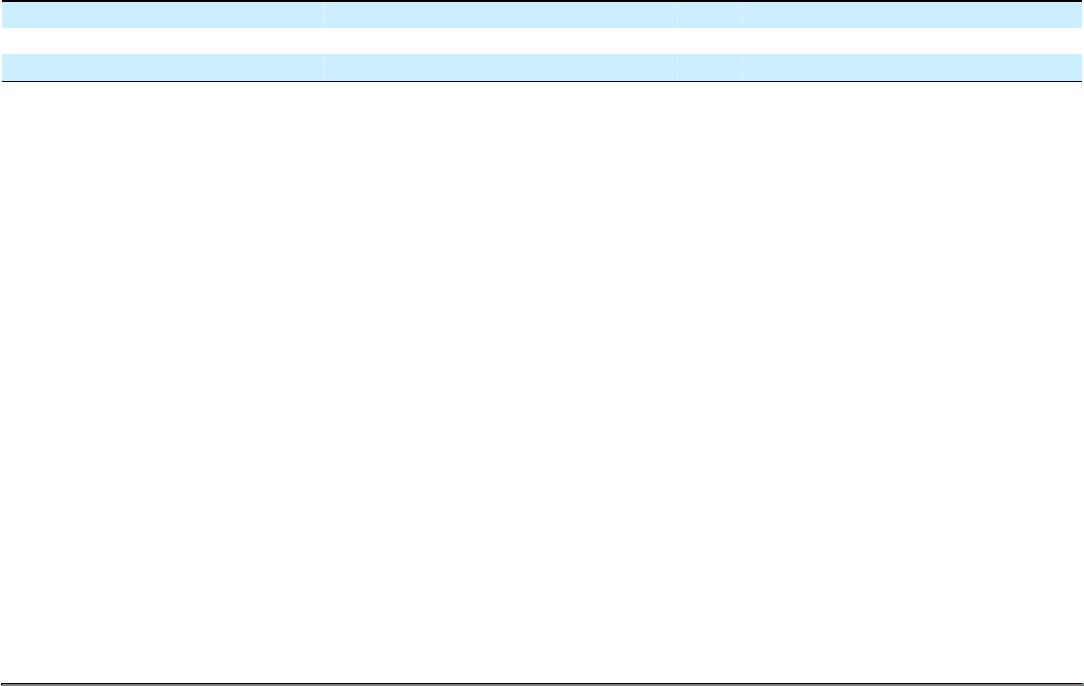

Our results of operations are significantly impacted by changes in the price and availability of aircraft fuel. The following table shows our aircraft fuel

consumption and costs.

Year Gallons Consumed (1) (Millions) Cost (1)(2) (Millions) Average Price Per Gallon (1)(2) Percentage of Total Operating Expense(1)

2011 3,856 $ 11,783 $ 3.06 36%

2010 3,823 $ 8,901 $ 2.33 30%

2009 3,853 $ 8,291 $ 2.15 29%

(1) Includes the operations of our contract carriers under capacity purchase agreements.

(2) Includes fuel hedge gains (losses) under our fuel hedging program of $420 million , $(89) million and $(1.4) billion for 2011, 2010 and 2009, respectively.

Our aircraft fuel purchase contracts do not provide material protection against price increases or assure the availability of our fuel supplies. We purchase

most of our aircraft fuel under contracts that establish the price based on various market indices. We also purchase aircraft fuel on the spot market, from off-

shore sources and under contracts that permit the refiners to set the price.

In an effort to manage our exposure to changes in aircraft fuel prices, we actively manage our fuel price risk through a hedging program intended to

provide an offset against increases in jet fuel prices. This fuel hedging program utilizes several different contract and fuel commodity types, which are used

together to create a risk mitigating hedge portfolio.

We are currently able to obtain adequate supplies of aircraft fuel, but it is impossible to predict the future availability or price of aircraft fuel. Weather-

related events, natural disasters, political disruptions or wars involving oil-producing countries, changes in government policy concerning aircraft fuel

production, transportation or marketing, changes in aircraft fuel production capacity, environmental concerns and other unpredictable events may result in fuel

supply shortages and fuel price increases in the future.

Competition

The airline industry is highly competitive, marked by significant competition with respect to routes, fares, schedules (both timing and frequency),

services, products, customer service and frequent flyer programs. The industry is going through a period of transformation through consolidation, both

domestically and internationally, and changes in international alliances. Consolidation in the airline industry and changes in international alliances have

altered and will continue to alter the competitive landscape in the industry by resulting in the formation of airlines and alliances with increased financial

resources, more extensive global networks and altered cost structures. In addition, other network carriers have also significantly reduced their costs over the

last several years including through restructuring and bankruptcy reorganization. American Airlines has recently filed for bankruptcy protection, which may

enable it to substantially reduce its costs. Our ability to compete effectively depends, in part, on our ability to maintain a competitive cost structure.

5