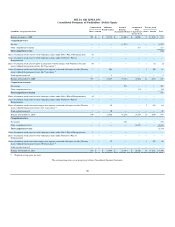

Delta Airlines 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

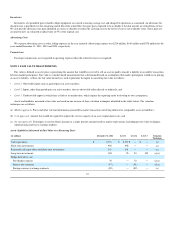

Accounts Receivable

Accounts receivable primarily consist of amounts due from credit card companies from the sale of passenger airline tickets, customers of our aircraft

maintenance and cargo transportation services and other companies for the purchase of mileage credits under our SkyMiles Program. We provide an

allowance for uncollectible accounts equal to the estimated losses expected to be incurred based on historical chargebacks, write-offs, bankruptcies and other

specific analyses. Bad debt expense was not material in any period presented.

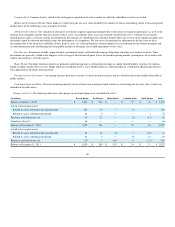

Derivatives

Our results of operations are impacted by changes in aircraft fuel prices, interest rates and foreign currency exchange rates. In an effort to manage our

exposure to these risks, we enter into derivative contracts and may adjust our derivative portfolio as market conditions change. We recognize derivative

contracts at fair value on our Consolidated Balance Sheets.

Not Designated as Accounting Hedges. Effective June 2011, we stopped designating new fuel derivative contracts as accounting hedges and discontinued

hedge accounting for our then existing fuel derivative contracts that previously had been designated as accounting hedges. As a result, we record market

adjustments for changes in fair value to earnings in aircraft fuel and related taxes. Prior to this change in accounting designation, gains or losses on these

contracts were deferred in accumulated other comprehensive loss until contract settlement.

Designated as Cash Flow Hedges. For derivative contracts designated as cash flow hedges, the effective portion of the gain or loss on the derivative is

reported as a component of accumulated other comprehensive loss and reclassified into earnings in the same period in which the hedged transaction affects

earnings. The effective portion of the derivative represents the change in fair value of the hedge that offsets the change in fair value of the hedged item. To the

extent the change in the fair value of the hedge does not perfectly offset the change in the fair value of the hedged item, the ineffective portion of the hedge is

immediately recognized in other (expense) income.

Designated as Fair Value Hedges. For derivative contracts designated as fair value hedges (interest rate contracts), the gain or loss on the derivative and

the offsetting loss or gain on the hedge item attributable to the hedged risk are recognized in current earnings. We include the gain or loss on the hedged item

in the same account as the offsetting loss or gain on the related derivative contract, resulting in no impact to our Consolidated Statements of Operations.

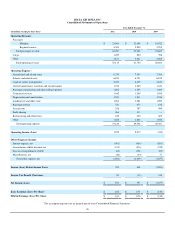

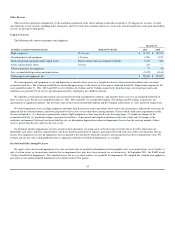

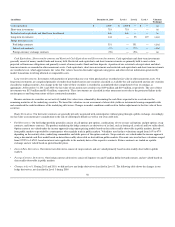

The following table summarizes the risk each type of derivative contract is hedging and the classification of related gains and losses on our Consolidated

Statements of Operations:

Derivative Type Hedged Risk Classification of Gains and Losses

Fuel hedge contracts Increases in jet fuel prices Aircraft fuel and related taxes

Interest rate contracts Increases in interest rates Interest expense, net

Foreign currency exchange contracts Fluctuations in foreign currency exchange rates Passenger revenue

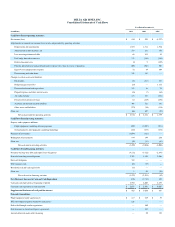

The following table summarizes the accounting treatment of our derivative contracts:

Impact of Unrealized Gains and Losses

Accounting Designation Effective Portion Ineffective Portion

Not designated as hedges Change in fair value of hedge is recorded in earnings

Designated as cash flow hedges Market adjustments are recorded in

accumulated other comprehensive loss

Excess, if any, over effective portion of hedge

is recorded in other (expense) income

Designated as fair value hedges Market adjustments are recorded in long-term

debt and capital leases

Excess, if any, over effective portion of hedge

is recorded in other (expense) income

52