Delta Airlines 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

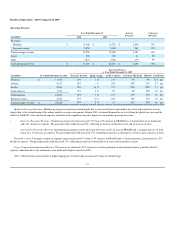

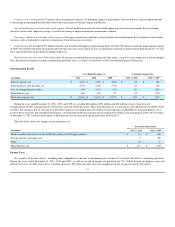

Annual Sale of SkyMiles. In December 2011, we amended our American Express agreements and sold American Express $675 million of SkyMiles.

Under the December 2011 amendment, we anticipate American Express will make additional purchases of $675 million of SkyMiles in each of 2012, 2013,

and 2014.

Fuel Card Obligation. In December 2011, we also obtained a purchasing card with American Express for the purpose of buying jet fuel. The card

currently carries a maximum credit limit of $612 million and must be paid monthly. As of December 31, 2011, we had $318 million outstanding on this

purchasing card, which was classified as other accrued liabilities.

Liquidity Events

Liquidity and financing events during 2011 included the following:

•Senior Secured Credit Facilities. We entered into senior secured first-lien credit facilities (the "Senior Secured Credit Facilities") to borrow up to $2.6

billion. We borrowed $1.4 billion under the Senior Secured Credit Facilities to retire $1.4 billion of outstanding loans under our $2.5 billion senior

secured exit financing facilities and terminated those facilities and an existing $100 million revolving credit facility. The Senior Secured Credit

Facilities bear interest at a variable rate equal to LIBOR (subject to a 1.25% floor) or another index rate, in each case plus a specified margin and have

final maturities in April 2016 and 2017. At December 31, 2011, the outstanding balances under the Senior Secured Credit Facilities had an interest

rate of 5.50% per annum.

• Pacific Routes Term Loan Facility. We amended our $250 million first-lien term loan facility (the "Pacific Routes Term Loan Facility") to, among

other things, reduce the interest rate and extend the maturity date from September 2013 to March 2016. At December 31, 2011 , the Pacific Routes

Term Loan Facility had an interest rate of 4.25% per annum.

•Certificates. We received $834 million in proceeds from offerings of Pass-Through Trust Certificates ("EETC") and used the proceeds to refinance

aircraft securing other debt instruments at their maturities, primarily the 2001-1 EETC, and for general corporate purposes. During 2011, we paid

$789 million to retire the outstanding principal amount under the 2001-1 EETC.

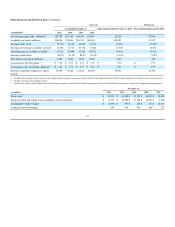

Sources and Uses of Cash

Cash Flows From Operating Activities

Cash provided by operating activities totaled $2.8 billion for 2011, primarily reflecting (1) $2.7 billion in net income after adjusting for items such as

depreciation and amortization and (2) $675 million received for the sale of SkyMiles. Cash provided by operating activities was reduced by $313 million in

profit sharing payments related to 2010 and other working capital changes.

Cash provided by operating activities totaled $2.8 billion for 2010, primarily reflecting (1) $2.6 billion in net income after adjusting for items such as

depreciation and amortization, (2) a $516 million increase in accounts payable and accrued liabilities primarily related to our broad-based employee profit

sharing plans and increased operations due to the improving economy and (3) a $232 million increase in advance ticket sales primarily due to an increase in

air fares. Cash provided by operating activities for the year ended December 31, 2010 was partially offset by a $345 million decrease in frequent flyer

liability.

Cash provided by operating activities totaled $1.4 billion for 2009, primarily reflecting the return from counterparties of $1.1 billion of hedge margin

primarily used to settle hedge losses recognized during the period and $690 million in net income after adjusting for items such as depreciation and

amortization.

Cash Flows From Investing Activities

Cash used in investing activities totaled $1.5 billion for 2011, primarily reflecting investments of (1) $907 million for flight equipment, including aircraft

modifications to invest in full flat bed seats in BusinessElite and in-seat audio and video entertainment systems, parts and advance deposits related to our

order to purchase 100 B-737-900ER aircraft, (2) $347 million for ground property and equipment (3) $240 million in net purchases of short-term investments

and (4) a $100 million investment in GOL. Included in flight equipment acquisitions are 12 previously owned MD-90 aircraft and one previously leased

B-767-300 aircraft.

35