Delta Airlines 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

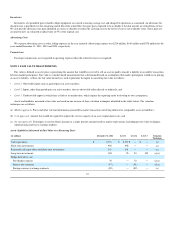

NOTE 6. AMERICAN EXPRESS RELATIONSHIP

General. Our agreements with American Express provide for joint marketing, grant certain benefits to Delta-American Express co-branded credit card

holders ("Cardholders") and American Express Membership Rewards Program participants, and allow American Express to market to our customer database.

Cardholders earn mileage credits for making purchases on their co-branded cards, may check their first bag for free on every Delta flight and enjoy other

benefits while traveling with Delta. Additionally, participants in the American Express Membership Rewards program may exchange their points for mileage

credits under the SkyMiles Program. As a result, we sell mileage credits at agreed upon rates to American Express for provision to their customers under the

co-brand credit card program and the Membership Rewards program.

Advance Purchase of SkyMiles. In 2008, we entered into a multi-year extension of our American Express agreements and received $1.0 billion from

American Express for an advance purchase of SkyMiles (the "prepayment"). The 2008 agreement provided that our obligations with respect to the advance

purchase would be satisfied as American Express uses the purchased miles over a specified future period (“SkyMiles Usage Period”), rather than by cash

payments from us to American Express. Due to the SkyMiles Usage Period and other restrictions placed upon American Express regarding the timing and use

of the SkyMiles, we classified the $1.0 billion we received, the prepayment, as long-term debt.

In 2010, we amended our 2008 American Express agreement. The amendments, among other things, (1) provide that Cardholders may check their first

bag for free on every Delta flight through June 2013 ("Baggage Fee Waiver Period"), (2) changed the SkyMiles Usage Period to a three-year period beginning

in the December 2011 quarter from a two-year period beginning in December 2010 quarter, and (3) gave American Express the option to extend our

agreements with them for one year.

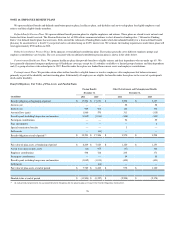

During the SkyMiles Usage Period, which commenced during the December 2011 quarter, American Express will draw down on the prepayment instead

of paying cash to Delta for SkyMiles used. As of December 31, 2011, $952 million of the original $1.0 billion debt (or prepayment) remained, including $333

million which is classified in current maturities of long-term debt and capital leases. As SkyMiles are used by American Express, we recognize the two

separate revenue components of these SkyMiles consistent with our accounting policy discussed in Note 1. We defer revenue related to the portion of the

mileage credits redeemable for future travel and recognize it as passenger revenue when miles are redeemed and services are provided. The value of the

marketing component is determined under the residual method and recognized as other revenue as related marketing services are provided.

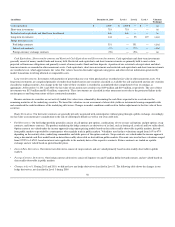

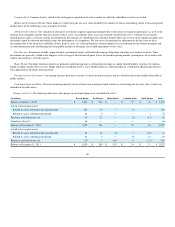

Annual Sale of SkyMiles. In December 2011, we further amended our American Express agreements and sold American Express $675 million of

SkyMiles. Under the December 2011 amendment, we anticipate American Express will make additional purchases of $675 million of SkyMiles in each of

2012, 2013, and 2014. The December 2011 amendment also extends the Baggage Fee Waiver Period. The SkyMiles purchased pursuant to the December

2011 amendment may be used immediately by American Express. The usage of these SkyMiles is not restricted in any way. These annual purchases of

SkyMiles will be recorded as deferred revenue within current liabilities. The portion of each purchase of SkyMiles related to mileage credits redeemable for

future travel will be classified within frequent flyer deferred revenue and the portion related to the marketing component will be classified within other

accrued liabilities.

The December 2011 amendment does not change the number of miles that we expect American Express to purchase from us over the next four years. It

only impacts the timing of those purchases. The December 2011 amendment did not make any significant changes to the deliverables (the mileage credits sold

and the marketing component). Therefore, it is not a material modification of the American Express agreements under the accounting guidance. A future

material modification of the American Express agreements could impact our deferral rate or cause an adjustment to our deferred revenue balance, which could

materially impact our future financial results. For additional information, see "Frequent Flyer Program" in Note 1.

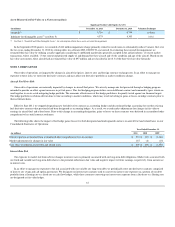

Fuel Card Obligation . In December 2011, we also obtained a purchasing card with American Express for the purpose of buying jet fuel. The card

currently carries a maximum credit limit of $612 million and must be paid monthly. As of December 31, 2011, we had $318 million outstanding on this

purchasing card, which was classified as other accrued liabilities.

66