Delta Airlines 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

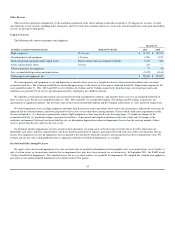

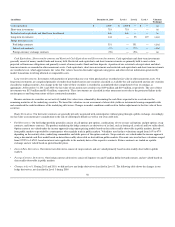

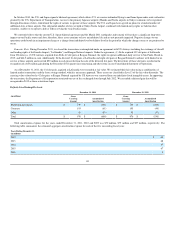

Assets Measured at Fair Value on a Nonrecurring Basis

Significant Unobservable Inputs (Level 3)

(in millions) December 31, 2011 December 31, 2010 Valuation Technique

Goodwill(1) $ 9,794 $ 9,794 (a)(b)(c)

Indefinite-lived intangible assets(1) (see Note 5) 4,375 4,303 (a)(c)

(1) See Note 1, “Goodwill and Other Intangible Assets”, for a description of how these assets are tested for impairment.

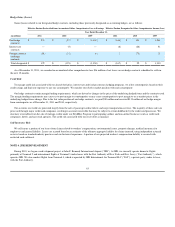

In the September 2010 quarter, we recorded a $146 million impairment charge primarily related to our decision to substantially reduce Comair's fleet over

the two years ending December 31, 2012 by retiring older, less-efficient CRJ-100/200 50-seat aircraft. In evaluating these aircraft for impairment, we

estimated their fair value by utilizing a market approach considering (1) published market data generally accepted in the airline industry, (2) recent market

transactions, where available, (3) the current and projected supply of and demand for these aircraft and (4) the condition and age of the aircraft. Based on our

fair value assessments, these aircraft had an estimated fair value of $97 million and are classified in Level 3 of the three-tier fair value hierarchy.

NOTE 3. DERIVATIVES

Our results of operations are impacted by changes in aircraft fuel prices, interest rates and foreign currency exchange rates. In an effort to manage our

exposure to these risks, we enter into derivative contracts and may adjust our derivative portfolio as market conditions change.

Aircraft Fuel Price Risk

Our results of operations are materially impacted by changes in aircraft fuel prices. We actively manage our fuel price risk through a hedging program

intended to provide an offset against increases in jet fuel prices. This fuel hedging program utilizes several different contract and commodity types, which are

used together to create a risk mitigating hedge portfolio. The economic effectiveness of this hedge portfolio is frequently tested against our financial targets.

The hedge portfolio is rebalanced from time to time according to market conditions, which may result in locking in gains or losses on hedge contracts prior to

their settlement dates .

Effective June 2011, we stopped designating new fuel derivative contracts as accounting hedges and discontinued hedge accounting for our then existing

fuel derivative contracts that previously had been designated as accounting hedges. As a result, we record market adjustments for changes in fair value to

earnings in aircraft fuel and related taxes. Prior to this change in accounting designation, gains or losses on these contracts were deferred in accumulated other

comprehensive loss until contract settlement.

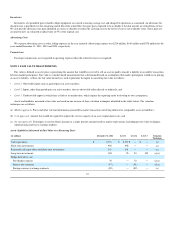

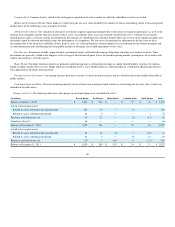

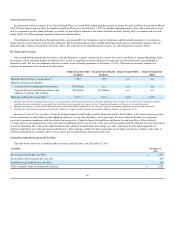

The following table shows the impact of fuel hedge gains (losses) for both designated and undesignated contracts on aircraft fuel and related taxes on our

Consolidated Statements of Operations:

Year Ended December 31,

(in millions) 2011 2010 2009

Effective portion reclassified from accumulated other comprehensive loss to earnings $ 233 $ (87) $ (1,344)

Market adjustments for changes in fair value 187 (2) (15)

Gain (loss) recorded in aircraft fuel and related taxes $ 420 $ (89) $ (1,359)

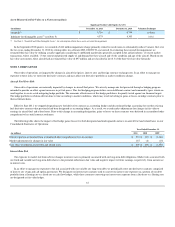

Interest Rate Risk

Our exposure to market risk from adverse changes in interest rates is primarily associated with our long-term debt obligations. Market risk associated with

our fixed and variable rate long-term debt relates to the potential reduction in fair value and negative impact to future earnings, respectively, from an increase

in interest rates.

In an effort to manage our exposure to the risk associated with our variable rate long-term debt, we periodically enter into derivative contracts comprised

of interest rate swaps and call option agreements. We designate our interest rate contracts used to convert our interest rate exposure on a portion of our debt

portfolio from a floating rate to a fixed rate as cash flow hedges, while those contracts converting our interest rate exposure from a fixed rate to a floating rate

are designated as fair value hedges.

61