Delta Airlines 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

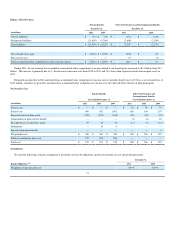

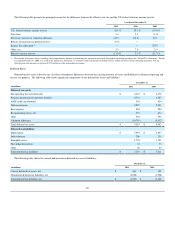

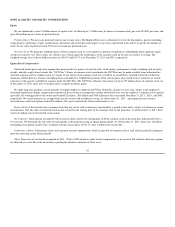

NOTE 10. EMPLOYEE BENEFIT PLANS

We sponsor defined benefit and defined contribution pension plans, healthcare plans, and disability and survivorship plans for eligible employees and

retirees and their eligible family members.

Defined Benefit Pension Plans. We sponsor defined benefit pension plans for eligible employees and retirees. These plans are closed to new entrants and

frozen for future benefit accruals. The Pension Protection Act of 2006 allows commercial airlines to elect alternative funding rules (“Alternative Funding

Rules”) for defined benefit plans that are frozen. Delta elected the Alternative Funding Rules under which the unfunded liability for a frozen defined benefit

plan may be amortized over a fixed 17-year period and is calculated using an 8.85% interest rate. We estimate the funding requirements under these plans will

total approximately $700 million in 2012.

Defined Contribution Pension Plans. Delta sponsors several defined contribution plans. These plans generally cover different employee groups and

employer contributions vary by plan. The cost associated with our defined contribution pension plans is shown in the tables below.

Postretirement Healthcare Plans. We sponsor healthcare plans that provide benefits to eligible retirees and their dependents who are under age 65 . We

have generally eliminated company-paid post age 65 healthcare coverage, except for (1) subsidies available to a limited group of retirees and their dependents

and (2) a group of retirees who retired prior to 1987. Benefits under these plans are funded from current assets and employee contributions.

Postemployment Plans. We provide certain other welfare benefits to eligible former or inactive employees after employment but before retirement,

primarily as part of the disability and survivorship plans. Substantially all employees are eligible for benefits under these plans in the event of a participant's

death and/or disability.

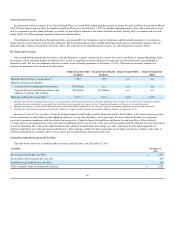

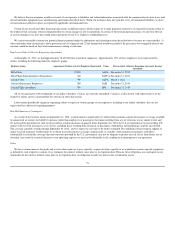

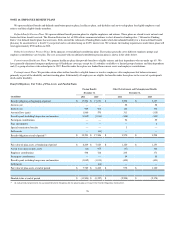

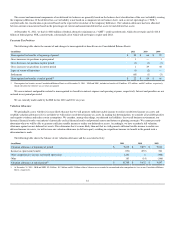

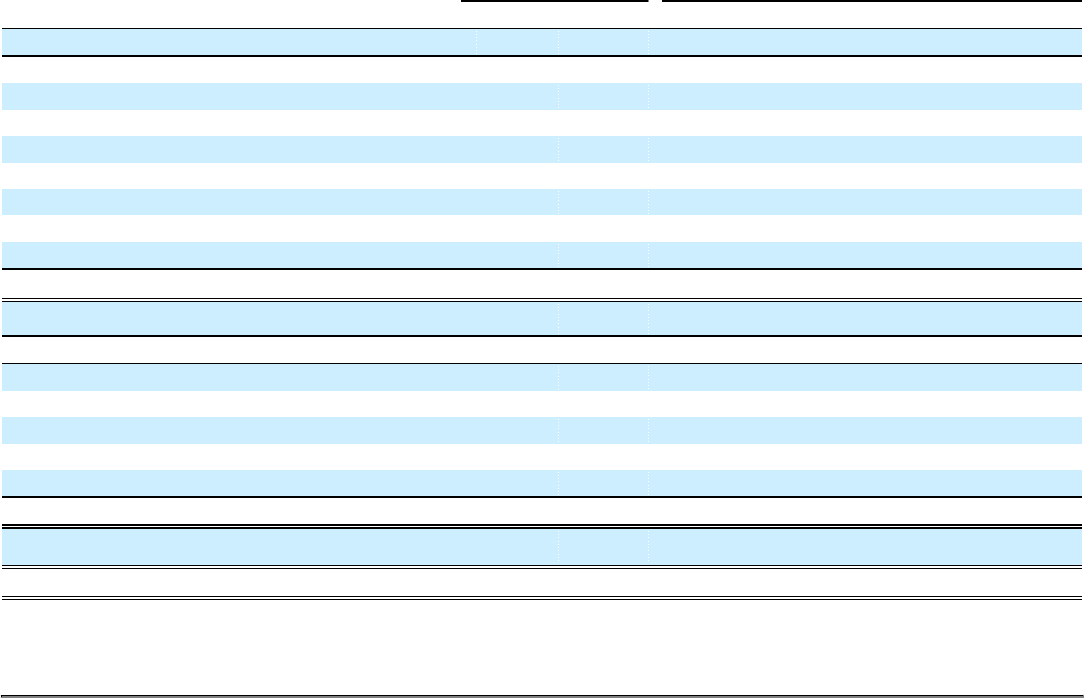

Benefit Obligations, Fair Value of Plan Assets, and Funded Status

Pension Benefits Other Postretirement and Postemployment Benefits

December 31, December 31,

(in millions) 2011 2010 2011 2010

Benefit obligation at beginning of period $ 17,506 $ 17,031 $ 3,298 $ 3,427

Service cost — — 52 58

Interest cost 969 982 180 196

Actuarial loss (gain) 1,860 570 311 (115)

Benefits paid, including lump sums and annuities (1,042) (1,013) (328) (333)

Participant contributions — — 54 59

Plan amendments — — — 6

Special termination benefits — — 3 —

Settlements — (64) — —

Benefit obligation at end of period(1) $ 19,293 $ 17,506 $ 3,570 $ 3,298

Fair value of plan assets at beginning of period $ 8,249 $ 7,623 $ 1,120 $ 1,153

Actual (loss) gain on plan assets (16) 975 (37) 140

Employer contributions 598 728 235 171

Participant contributions — — 54 59

Benefits paid, including lump sums and annuities (1,042) (1,013) (400) (403)

Settlements — (64) — —

Fair value of plan assets at end of period $ 7,789 $ 8,249 $ 972 $ 1,120

Funded status at end of period $ (11,504) $ (9,257) $ (2,598) $ (2,178)

(1) At each period-end presented, our accumulated benefit obligations for our pension plans are equal to the benefit obligations shown above.

76