Delta Airlines 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

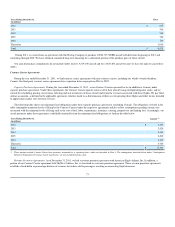

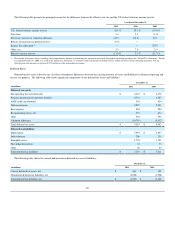

Other Secured Financing Arrangements

During 2011, we retired $502 million of existing debt under our other secured financing arrangements prior to scheduled maturity. During 2010, we (1)

repurchased in cash tender offers $129 million of Pass-Through Trust Certificates, (2) achieved $160 million of debt relief through vendor negotiations and

(3) prepaid or repurchased $403 million of other existing debt.

In 2010, we also restructured $820 million of existing debt, including changes in applicable interest rates and other payment terms. To account for debt

restructurings, we compare the net present value of future cash flows for each new debt instrument to the remaining cash flows of the existing debt. If there is

at least a 10% change in cash flows, we treat the restructuring as a debt extinguishment. We record losses on extinguishment of debt for the difference

between the fair value of the new debt and the carrying value of the existing debt. The carrying value of the existing debt includes any unamortized discounts

or premiums, unamortized issuance costs, and any premiums paid to retire the existing debt.

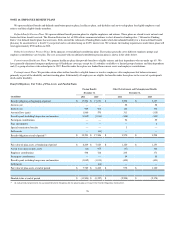

Certificates. Pass-Through Trust Certificates and Enhanced Equipment Trust Certificates (“EETC”) (collectively, the “Certificates”) are secured by 262

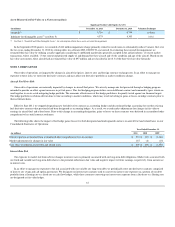

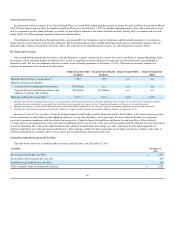

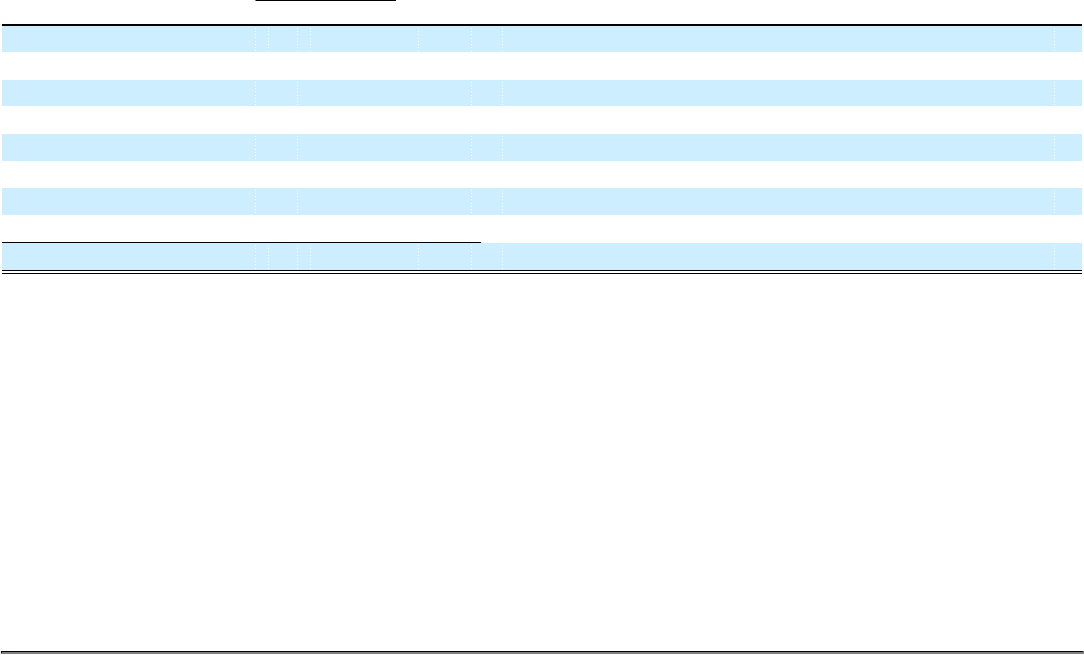

aircraft. During the three years ended December 31, 2011, we received proceeds from offerings of EETC as shown in the table below.

(In millions, unless otherwise stated) Proceeds Received Fixed Interest Rate Offering Completion Date Final Maturity Date Collateral

2011 2010 2009 Total Principal

2011-1A $ 293 $ — $ — $ 293 5.300% April 2011 April 2019 26 aircraft

2011-1B 102 — — 102 7.125% August 2011 October 2014 26 aircraft (1)

2010-2A 204 270 — 474 4.950% November 2010 May 2019 28 aircraft

2010-2B 135 — — 135 6.750% February 2011 November 2015 28 aircraft (1)

2010-1A — 450 — 450 6.200% July 2010 July 2018 24 aircraft

2010-1B 100 — — 100 6.375% February 2011 January 2016 24 aircraft (1)

2009-1A — 288 281 569 7.750% November 2009 December 2019 27 aircraft

2009-1B — 59 61 120 9.750% November 2009 December 2016 27 aircraft (1)

Total $ 834 $ 1,067 $ 342 $ 2,243

(1) Each of the B tranches are secured by the same aircraft that secure related A tranches.

As of December 31, 2010, $204 million held in escrow under the 2010-2A EETC was not recorded on the balance sheet as we had no right to these funds

until the equipment notes securing the certificates were issued. We assessed whether the pass through trusts were variable interest entities required to be

consolidated. Because our only obligation with respect to the trusts is to make interest and principal payments on the equipment notes held by the trusts and

because we have no current rights to the escrowed funds, we concluded we do not have a variable interest in the related trusts. Accordingly, we did not

consolidate them. As of December 31, 2011, no amounts remained in escrow.

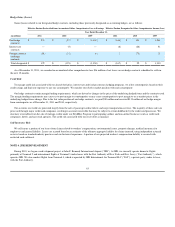

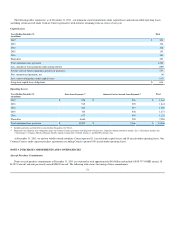

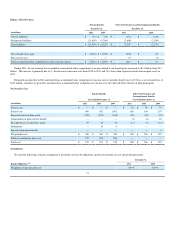

Unamortized Discount, Net

Our unamortized discount, net results from fair value adjustments recorded in 2008 to reduce the carrying value of our long-term debt due to purchase

accounting and an advance purchase of SkyMiles by American Express (see Note 6). As described in the table below, we amortize these adjustments over the

remaining maturities of the respective debt to amortization of debt discount, net on our Consolidated Statements of Operations. During the years ended

December 31, 2011, 2010 and 2009, we recorded $68 million, $391 million and $83 million in losses, respectively, from the early extinguishment of debt,

which primarily related to the write-off of debt discounts.

70