Delta Airlines 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

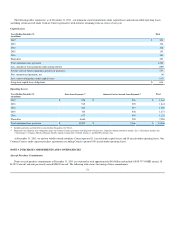

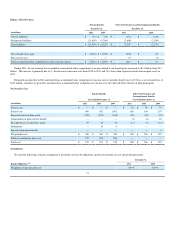

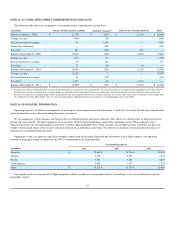

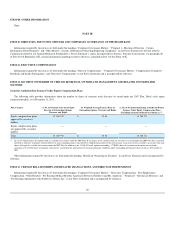

The following table presents the principal reasons for the difference between the effective tax rate and the U.S. federal statutory income tax rate:

Year Ended December 31,

2011 2010 2009

U.S. federal statutory income tax rate 35.0 % 35.0 % (35.0)%

State taxes 3.4 2.3 (1.8)

(Decrease) increase in valuation allowance (45.7) (42.3) 32.9

Release of uncertain tax position reserve (9.0) — —

Income Tax Allocation(1) — — (20.2)

Other, net 5.3 7.6 2.4

Effective income tax rate (11.0)% 2.6 % (21.7)%

(1) We consider all income sources, including other comprehensive income, in determining the amount of tax benefit allocated to continuing operations (the “Income Tax Allocation”). For the

year ended December 31, 2009, as a result of the Income Tax Allocation, we recorded a non-cash income tax benefit of $321 million on the loss from continuing operations, with an

offsetting non-cash income tax expense of $321 million in other comprehensive income.

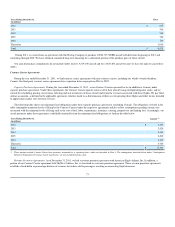

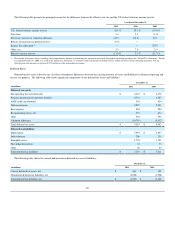

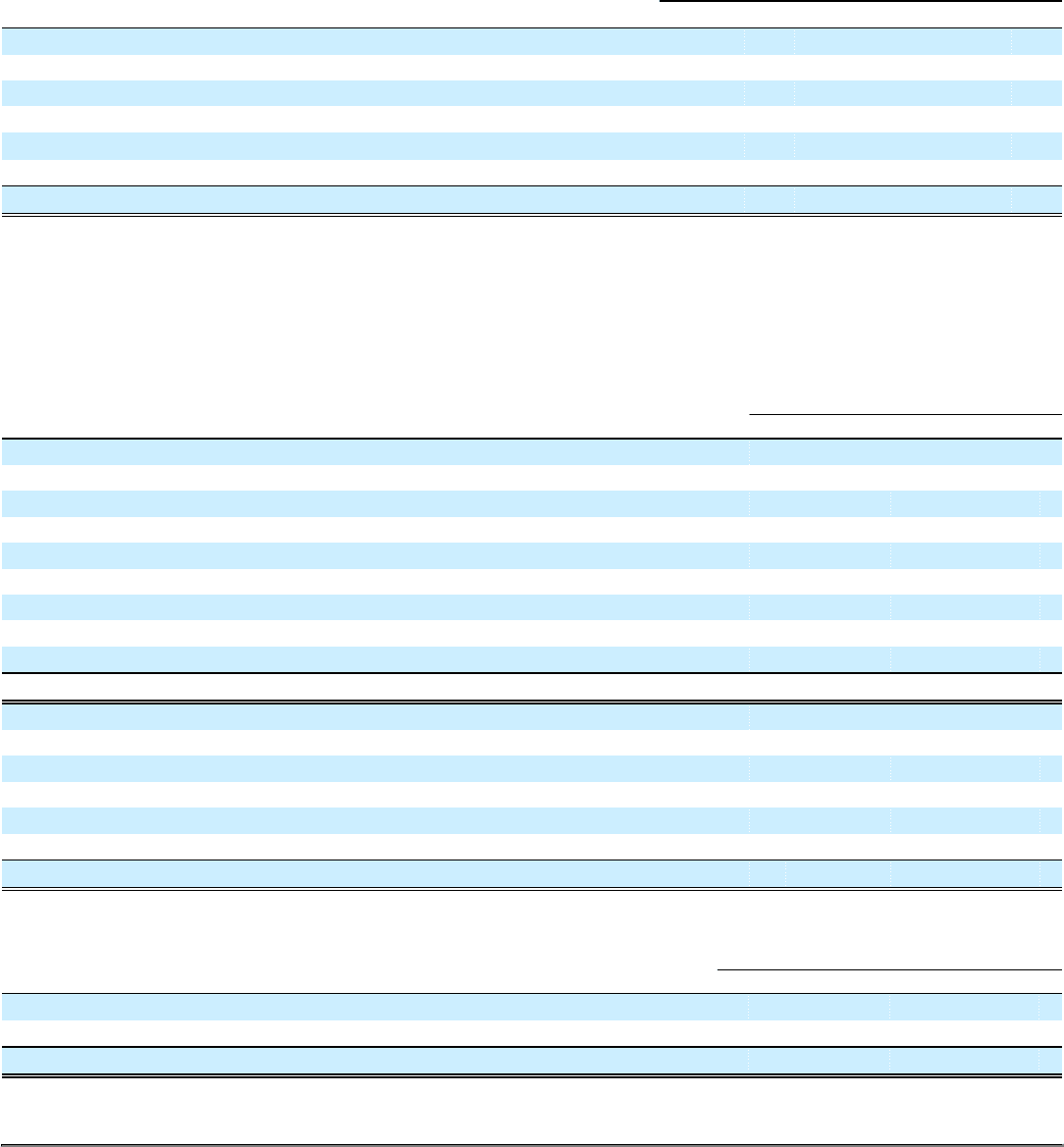

Deferred Taxes

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amounts of assets and liabilities for financial reporting and

income tax purposes. The following table shows significant components of our deferred tax assets and liabilities:

December 31,

(in millions) 2011 2010

Deferred tax assets:

Net operating loss carryforwards $ 6,647 $ 6,472

Pension, postretirement and other benefits 5,703 4,527

AMT credit carryforward 402 424

Deferred revenue 2,297 2,202

Rent expense 284 280

Reorganization items, net 395 674

Other 564 495

Valuation allowance (10,705) (9,632)

Total deferred tax assets $ 5,587 $ 5,442

Deferred tax liabilities:

Depreciation $ 5,093 $ 4,837

Debt valuation 206 330

Intangible assets 1,755 1,731

Fuel hedge derivatives 32 73

Other 68 40

Total deferred tax liabilities $ 7,154 $ 7,011

The following table shows the current and noncurrent deferred tax assets (liabilities):

December 31,

(in millions) 2011 2010

Current deferred tax assets, net $ 461 $ 355

Noncurrent deferred tax liabilities, net (2,028) (1,924)

Total deferred tax liabilities, net $ (1,567) $ (1,569)

80