Delta Airlines 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Contract carrier arrangements. Contract carrier arrangements expense, excluding the impact of fuel expense (discussed above), increased primarily due

to the change in reporting described above due to the transactions involving Compass and Mesaba.

Aircraft maintenance materials and outside repairs. Aircraft maintenance materials and outside repairs expense increased primarily due to returning

aircraft to service after temporary storage, as well as the timing of engine and airframe maintenance volumes.

Passenger commissions and other selling expenses. Passenger commissions and other selling expenses increased primarily due to higher revenue-related

expenses, such as booking fees and sales commissions, from the increase in revenue.

Profit sharing. We recorded $313 million related to our broad-based employee profit sharing plans for 2010. We did not record any profit sharing expense

in 2009. Our broad-based profit sharing plans provide that, for each year in which we have an annual pre-tax profit (as defined in the plan document), we will

pay a specified portion of that profit to eligible employees.

Restructuring and other items. Due to the nature of amounts recorded within restructuring and other items, a year over year comparison is not meaningful.

For a discussion of charges recorded in restructuring and other items, see Note 15 to the Notes of the Consolidated Financial Statements.

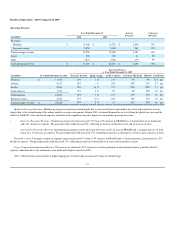

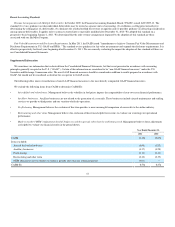

Non-Operating Results

Year Ended December 31, Favorable (Unfavorable)

(in millions) 2011 2010 2009 2011 vs. 2010 2010 vs. 2009

Interest expense, net $ (901) $ (969) $ (881) $ 68 $ (88)

Amortization of debt discount, net (193) (216) (370) 23 154

Loss on extinguishment of debt (68) (391) (83) 323 (308)

Miscellaneous, net (44) (33) 77 (11) (110)

Total other expense, net $ (1,206) $ (1,609) $ (1,257) $ 403 $ (352)

During the years ended December 31, 2011, 2010 and 2009, we recorded $68 million, $391 million and $83 million in losses from the early

extinguishment of debt, which primarily related to the write-off of debt discounts. These debt discounts are a result of fair value adjustments recorded in 2008

to reduce the carrying value of our long-term debt due to purchase accounting and a $1.0 billion advance purchase of SkyMiles by American Express. As a

result of these write-offs and scheduled amortization, our unamortized debt discount has decreased from $1.9 billion at the beginning of 2009 to $737 million

at December 31, 2011 and our amortization of debt discount, net has decreased significantly from 2009 to 2011.

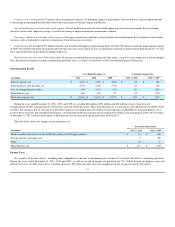

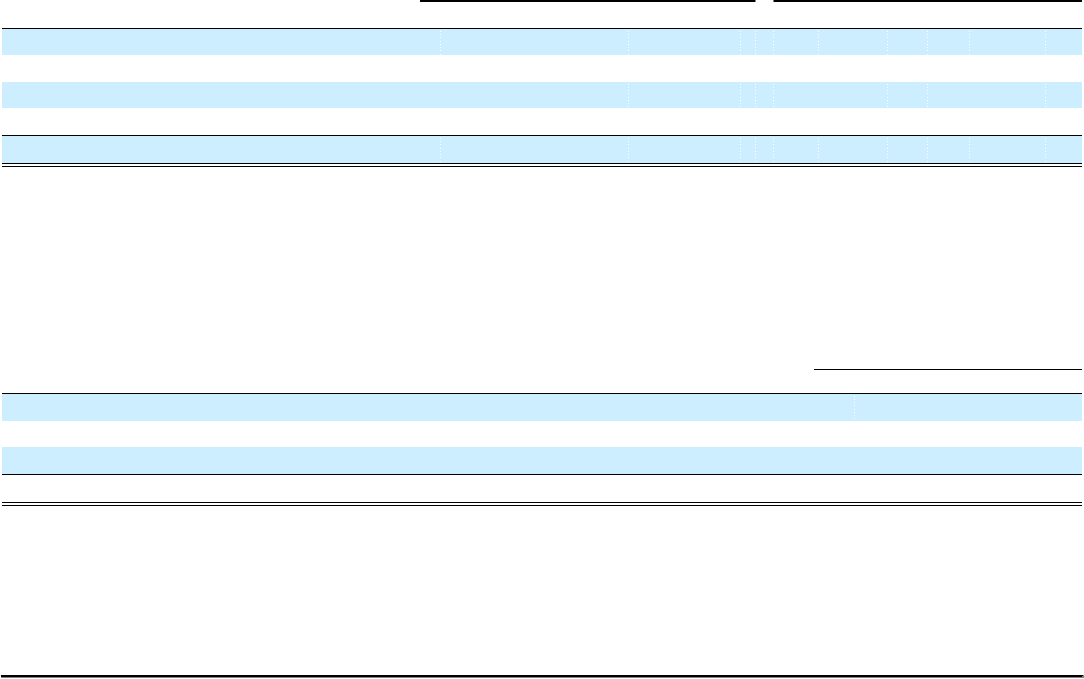

The table below shows the changes in miscellaneous, net:

Favorable (Unfavorable)

(in millions) 2011 vs. 2010 2010 vs. 2009

Mark-to-market adjustments on the ineffective portion of fuel hedge contracts $ (6) $ (61)

Foreign currency exchange rates 3 (52)

Other (8) 3

Miscellaneous, net $ (11) $ (110)

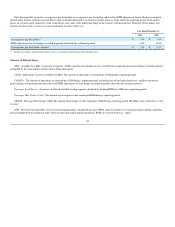

Income Taxes

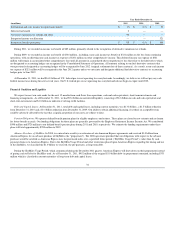

We consider all income sources, including other comprehensive income, in determining the amount of tax benefit allocated to continuing operations.

During the years ended December 31, 2011, 2010 and 2009, we did not record an income tax provision for U.S. federal income tax purposes since our

deferred tax assets are fully reserved by a valuation allowance. The following table shows the components of our income tax benefit (provision):

33