Delta Airlines 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

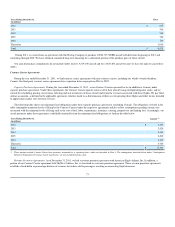

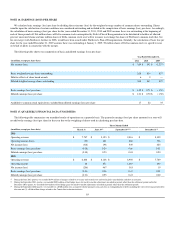

NOTE 13. ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

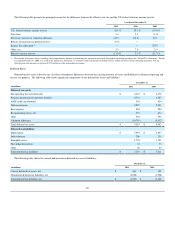

The following table shows the components of accumulated other comprehensive income (loss):

(in millions) Pension and Other Benefits Liabilities Derivative Contracts(1) Deferred Tax Valuation Allowance Total

Balance at January 1, 2009 $ (1,702) $ (863) $ (1,515) $ (4,080)

Changes in value (540) (20) — (560)

Reclassification into earnings 48 1,350 — 1,398

Income Tax Allocation — (321) — (321)

Tax effect 183 (491) 308 —

Balance at December 31, 2009 (2,011) (345) (1,207) (3,563)

Changes in value (121) (71) — (192)

Reclassification into earnings 54 123 — 177

Tax effect 25 (19) (6) —

Balance at December 31, 2010 (2,053) (312) (1,213) (3,578)

Changes in value (3,062) 5 — (3,057)

Reclassification into earnings 41 (172) — (131)

Tax effect 1,175 66 (1,241) —

Balance at December 31, 2011 $ (3,899) $ (413) $ (2,454) $ (6,766)

(1) Includes $321 million of deferred income tax expense that will remain in accumulated other comprehensive loss until all amounts in accumulated other comprehensive loss that relate to

fuel derivatives which are designated as accounting hedges are recognized in the Consolidated Statement of Operations. All amounts relating to our fuel derivative contracts that were

previously designated as accounting hedges will be recognized by June 2012 (original settlement date of those contracts). As a result, a non-cash income tax expense of $321 million will

be recognized in the June 2012 quarter unless we enter into and designate additional fuel derivative contracts as accounting hedges prior to June 2012.

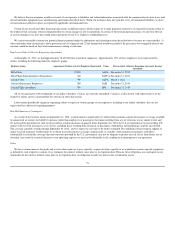

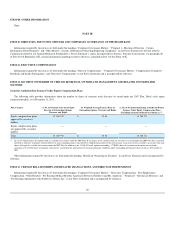

NOTE 14. GEOGRAPHIC INFORMATION

Operating segments are defined as components of an enterprise whose separate financial information is regularly reviewed by the chief operating decision

maker and used in resource allocation and performance assessments.

We are managed as a single business unit that provides air transportation for passengers and cargo. This allows us to benefit from an integrated revenue

pricing and route network. Our flight equipment forms one fleet, which is deployed through a single route scheduling system. When making resource

allocation decisions, our chief operating decision maker evaluates flight profitability data, which considers aircraft type and route economics, but gives no

weight to the financial impact of the resource allocation decision on an individual carrier basis. Our objective in making resource allocation decisions is to

optimize our consolidated financial results.

Operating revenue is assigned to a specific geographic region based on the origin, flight path and destination of each flight segment. Our operating

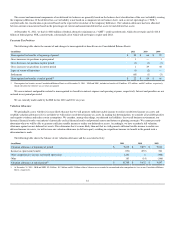

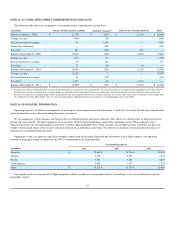

revenue by geographic region (as defined by the DOT) is summarized in the following table:

Year Ended December 31,

(in millions) 2011 2010 2009

Domestic $ 22,649 $ 20,744 $ 19,043

Atlantic 6,499 5,931 4,970

Pacific 3,943 3,283 2,485

Latin America 2,024 1,797 1,565

Total $ 35,115 $ 31,755 $ 28,063

Our tangible assets consist primarily of flight equipment, which is mobile across geographic markets. Accordingly, assets are not allocated to specific

geographic regions.

83