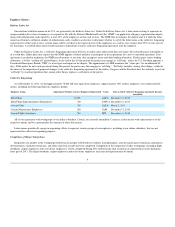

Delta Airlines 2011 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our business is subject to the effects of weather and natural disasters and seasonality, which can cause our results to fluctuate.

Our results of operations will reflect fluctuations from weather, natural disasters and seasonality. Severe weather conditions and natural disasters can

significantly disrupt service and create air traffic control problems. These events decrease revenue and can also increase costs. In addition, increases in

frequency, severity or duration of thunderstorms, hurricanes, typhoons or other severe weather events, including from changes in the global climate, could

result in increases in fuel consumption to avoid such weather, turbulence-related injuries, delays and cancellations, any of which would increase the potential

for greater loss of revenue and higher costs. In addition, demand for air travel is typically higher in the June and September quarters, particularly in

international markets, because there is more vacation travel during these periods than during the remainder of the year. Because of fluctuations in our results

from weather, natural disasters and seasonality, operating results for a historical period are not necessarily indicative of operating results for a future period

and operating results for an interim period are not necessarily indicative of operating results for an entire year.

An extended disruption in services provided by our third party regional carriers could have a material adverse effect on our results of operations.

We utilize the services of third party providers in a number of areas in support of our operations that are integral to our business, including third party

carriers in the Delta Connection program. While we have agreements with these providers that define expected service performance, we do not have direct

control over the operations of these carriers. To the extent that a significant disruption in our regional operations occurs because any of these providers are

unable to perform their obligations over an extended period of time, our revenue may be reduced or our expenses may be increased resulting in a material

adverse effect on our results of operations.

If we experience losses of senior management personnel and other key employees, our operating results could be adversely affected.

We are dependent on the experience and industry knowledge of our officers and other key employees to execute our business plans. If we experience a

substantial turnover in our leadership and other key employees, our performance could be materially adversely impacted. Furthermore, we may be unable to

attract and retain additional qualified executives as needed in the future.

Our ability to use net operating loss carryforwards to offset future taxable income for U.S. federal income tax purposes is subject to limitation.

In general, under Section 382 of the Internal Revenue Code of 1986, as amended, a corporation that undergoes an “ownership change” is subject to

limitations on its ability to utilize its pre-change net operating losses (“NOLs”), to offset future taxable income. In general, an ownership change occurs if the

aggregate stock ownership of certain stockholders (generally 5% shareholders, applying certain look-through rules) increases by more than 50 percentage

points over such stockholders' lowest percentage ownership during the testing period (generally three years).

As of December 31, 2011, Delta reported a consolidated federal pretax NOL carryforward of approximately $16.8 billion. Both Delta and Northwest

experienced an ownership change in 2007 as a result of their respective plans of reorganization under Chapter 11 of the U.S. Bankruptcy Code. As a result of

the merger, Northwest experienced a subsequent ownership change. Delta also experienced a subsequent ownership change on December 17, 2008 as a result

of the merger, the issuance of equity to employees in connection with the merger and other transactions involving the sale of our common stock within the

testing period.

The Delta and Northwest ownership changes resulting from the merger could limit the ability to utilize pre-change NOLs that were not subject to

limitation, and could further limit the ability to utilize NOLs that were already subject to limitation. Limitations imposed on the ability to use NOLs to offset

future taxable income could cause U.S. federal income taxes to be paid earlier than otherwise would be paid if such limitations were not in effect and could

cause such NOLs to expire unused, in each case reducing or eliminating the benefit of such NOLs. Similar rules and limitations may apply for state income

tax purposes. NOLs generated subsequent to December 17, 2008 are not limited.

14