Delta Airlines 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

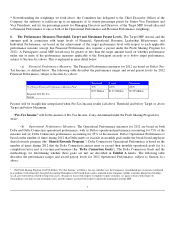

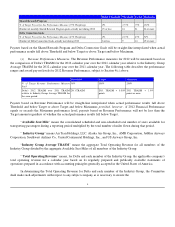

that the Company's actual performance results meet or exceed Threshold level with respect to Average Annual Operating

Income Margin Customer Service Performance and/or Return on Invested Capital, as applicable and as described below.

For purposes of Average Annual Operating Income Margin, the Company's performance is compared against the

Composite Performance of the Industry Composite Group.

(B) Committee's Authority. In determining the Average Annual Operating Income Margin for Delta and each

member of the Industry Composite Group and the Return on Invested Capital for Delta, the Committee shall make such

adjustments with respect to any subject company as is necessary to ensure the results are comparable, including, without

limitation, differences in accounting policies (for example, fuel hedging, purchase accounting adjustments associated with

mergers, acquisitions or divestures, fresh start accounting as a result of emergence from bankruptcy). Without limiting the

generality of the forgoing, the Committee shall (i) make such determinations based on financial data filed by the subject

company with the U.S. Department of Transportation or otherwise, and (ii) exclude from any calculation any item of gain,

loss or expense to be extraordinary or unusual in nature or infrequent in occurrence.

(C) Impact of Certain Events. A company shall be automatically removed from the Industry Composite Group

in the event that any of the following occur during or with respect to the Performance Period: (i) such company ceases to

maintain or does not timely prepare publicly available statements of operations prepared in accordance with GAAP;

(ii) such company is not the surviving entity in any merger, consolidation, or other non-bankruptcy reorganization (or

survives only as a subsidiary of an entity other than a previously wholly owned subsidiary of such company); (iii) such

company sells, leases, or exchanges all or substantially all of its assets to any other person or entity (other than a

previously wholly owned subsidiary of such company); (iv) such company is dissolved and liquidated; or (v) more than

20% of such company's revenues (determined on a consolidated basis based on the regularly prepared and publicly

available statements of operations of such company prepared in accordance with GAAP) for any fiscal year of such

company are attributable to the operation of businesses other than such company's airline business and such company does

not provide publicly available statements of operations with respect to its airline business that are separate from the

statements of operations provided with respect to its other businesses.

(D) Transactions Between Airlines. To the extent reasonably practicable, in the event of a merger,

consolidation or similar transaction during the Performance Period between Delta and any other airline, including a

member of the Industry Composite Group, or between any member of the Industry Composite Group and any other

airline, including another member of the Industry Composite Group (an “ Airline Merger”), Average Annual Operating

Income Margin for such company will be calculated on a combined basis as if the Airline Merger had occurred on January

1, 2012.

(E) Vesting/Performance Measures. The payment, if any, a Participant will receive in connection with the

vesting of the Performance Award will be based on the following:

7