Delta Airlines 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

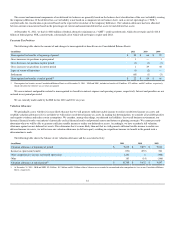

The current and noncurrent components of our deferred tax balances are generally based on the balance sheet classification of the asset or liability creating

the temporary difference. If the deferred tax asset or liability is not based on a component of our balance sheet, such as our net operating loss (“NOL”)

carryforwards, the classification is presented based on the expected reversal date of the temporary difference. Our valuation allowance has been allocated

between current or noncurrent based on the percentages of current and noncurrent deferred tax assets to total deferred tax assets.

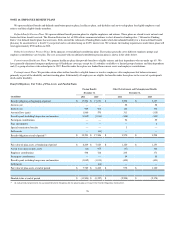

At December 31, 2011, we had (1) $402 million of federal alternative minimum tax (“AMT”) credit carryforwards, which do not expire and (2) $16.8

billion of federal pretax NOL carryforwards, substantially all of which will not begin to expire until 2022.

Uncertain Tax Positions

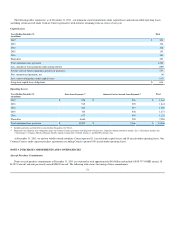

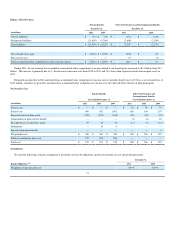

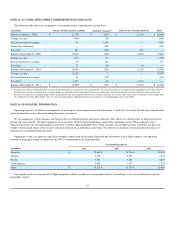

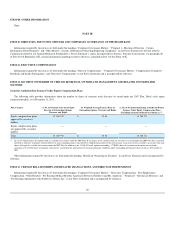

The following table shows the amount of and changes to unrecognized tax benefits on our Consolidated Balance Sheets:

(in millions) 2011 2010 2009

Unrecognized tax benefits at beginning of period $ 89 $ 66 $ 29

Gross increases-tax positions in prior period 1 — 1

Gross decreases-tax positions in prior period (3) (3) (1)

Gross increases-tax positions in current period 1 29 40

Lapse of statute of limitations (1) (2) —

Settlements (65) (1) (3)

Unrecognized tax benefits at end of period(1) $ 22 $ 89 $ 66

(1) Unrecognized tax benefits on our Consolidated Balance Sheets as of December 31, 2011 , 2010 and 2009 , include tax benefits of $5 million , $72 million , and $47 million , respectively,

which will affect the effective tax rate when recognized.

We accrue interest and penalties related to unrecognized tax benefits in interest expense and operating expense, respectively. Interest and penalties are not

material in any period presented.

We are currently under audit by the IRS for the 2010 and 2011 tax years.

Valuation Allowance

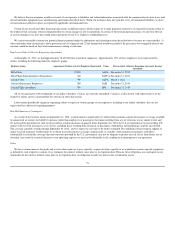

We periodically assess whether it is more likely than not that we will generate sufficient taxable income to realize our deferred income tax assets and

establish valuation allowances if it is not likely we will realize our deferred income tax assets. In making this determination, we consider all available positive

and negative evidence and make certain assumptions. We consider, among other things, our deferred tax liabilities, the overall business environment, our

historical financial results, our industry's historically cyclical financial results and potential current and future tax planning strategies. We cannot presently

determine when we will be able to generate sufficient taxable income to realize our deferred tax assets. Accordingly, we have recorded a full valuation

allowance against our net deferred tax assets. If we determine that it is more likely than not that we will generate sufficient taxable income to realize our

deferred income tax assets, we will reverse our valuation allowance (in full or in part), resulting in a significant income tax benefit in the period such a

determination is made.

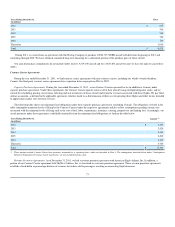

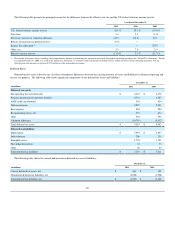

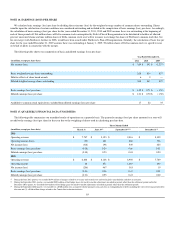

The following table shows the balance of our valuation allowance and the associated activity:

(in millions) 2011 2010 2009

Valuation allowance at beginning of period $ 9,632 $ 9,897 $ 9,830

Income tax (provision) benefit (351) (257) 521

Other comprehensive income tax benefit (provision) 1,241 6 (308)

Other 183 (14) (146)

Valuation allowance at end of period(1) $ 10,705 $ 9,632 $ 9,897

(1) At December 31, 2011 , 2010 and 2009 , $2.5 billion , $1.2 billion and $1.2 billion of these balances were recorded in accumulated other comprehensive loss on our Consolidated Balance

Sheets, respectively.

81