Delta Airlines 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

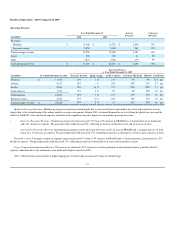

Recent Accounting Standards

Revenue Arrangements with Multiple Deliverables. In October 2009, the Financial Accounting Standards Board ("FASB") issued ASU 2009-13. The

standard (1) revises guidance on when individual deliverables may be treated as separate units of accounting, (2) establishes a selling price hierarchy for

determining the selling price of a deliverable, (3) eliminates the residual method for revenue recognition and (4) provides guidance on allocating consideration

among separate deliverables. It applies only to contracts entered into or materially modified after December 31, 2010. We adopted this standard on a

prospective basis beginning January 1, 2011. We determined that the only revenue arrangements impacted by the adoption of this standard are those

associated with our SkyMiles Program.

Fair Value Measurement and Disclosure Requirements. In May 2011, the FASB issued "Amendments to Achieve Common Fair Value Measurement and

Disclosure Requirements in U.S. GAAP and IFRSs." The standard revises guidance for fair value measurement and expands the disclosure requirements. It is

effective prospectively for fiscal years beginning after December 15, 2011. We are currently evaluating the impact the adoption of this standard will have on

our Consolidated Financial Statements.

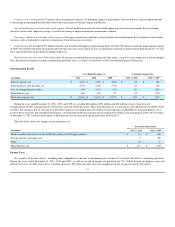

Supplemental Information

We sometimes use information that is derived from the Consolidated Financial Statements, but that is not presented in accordance with accounting

principles generally accepted in the U.S. (“GAAP”). Certain of this information are considered to be “non-GAAP financial measures” under the U.S.

Securities and Exchange Commission rules. The non-GAAP financial measures should be considered in addition to results prepared in accordance with

GAAP, but should not be considered a substitute for or superior to GAAP results.

The following tables show reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures.

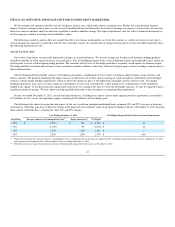

We exclude the following items from CASM to determine CASM-Ex:

•Aircraft fuel and related taxes. Management believes the volatility in fuel prices impacts the comparability of year-over-year financial performance.

•Ancillary businesses . Ancillary businesses are not related to the generation of a seat mile. These businesses include aircraft maintenance and staffing

services we provide to third parties and our vacation wholesale operations.

•Profit sharing. Management believes the exclusion of this item provides a more meaningful comparison of our results to the airline industry.

•Restructuring and other items. Management believes the exclusion of this item is helpful to investors to evaluate our recurring core operational

performance.

•Mark-to-market ("MTM") adjustments for fuel hedges recorded in periods other than the settlement period. Management believes these adjustments

are helpful to evaluate our financial results in the period shown.

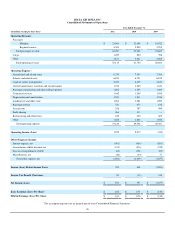

Year Ended December 31,

2011 2010

CASM 14.12¢ 12.69¢

Items excluded:

Aircraft fuel and related taxes (5.00) (3.82)

Ancillary businesses (0.37) (0.28)

Profit sharing (0.11) (0.13)

Restructuring and other items (0.10) (0.19)

MTM adjustments for fuel hedges recorded in periods other than the settlement period (0.01) —

CASM-Ex 8.53¢ 8.27¢

41