Delta Airlines 2011 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

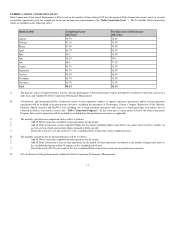

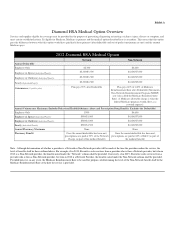

Exhibit A

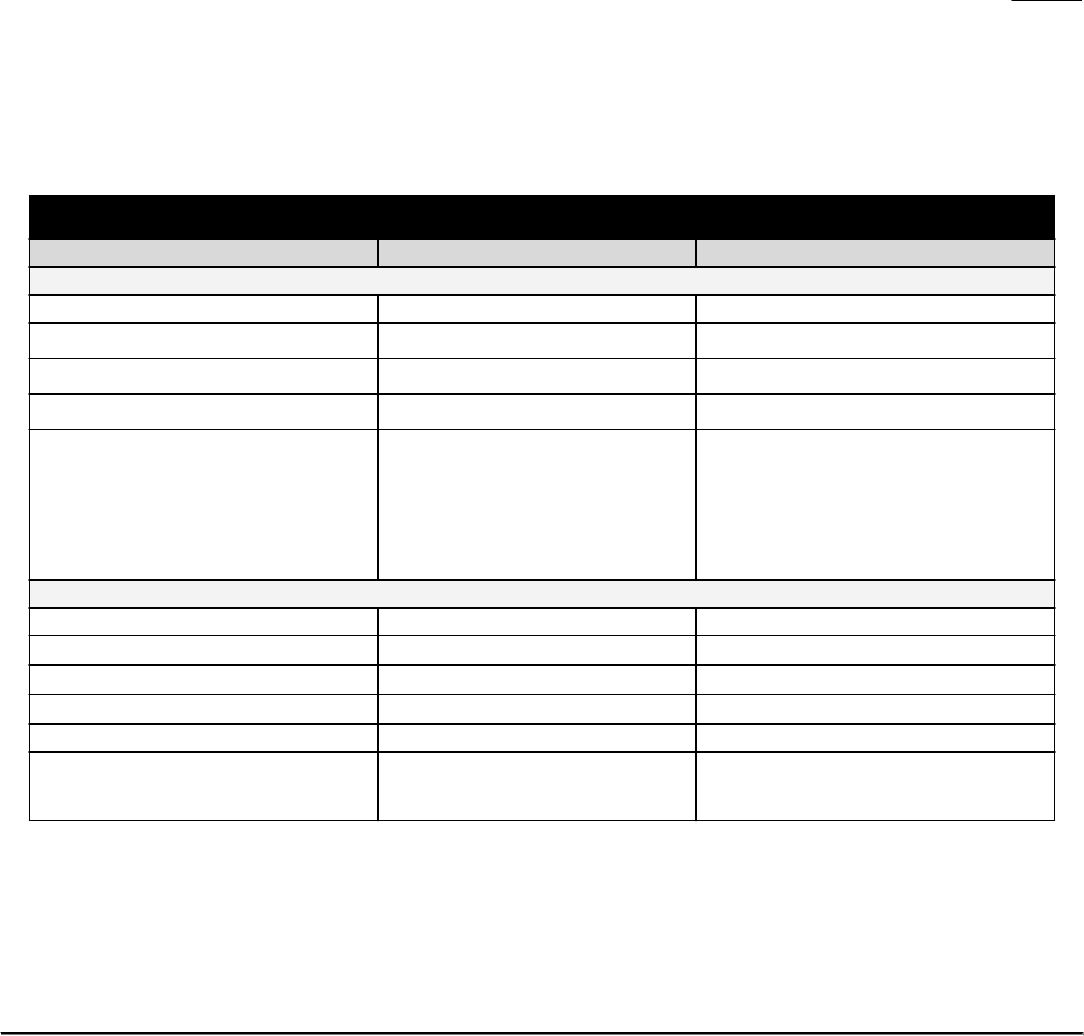

Diamond HSA Medical Option Overview

Services and supplies eligible for coverage must be provided for the purpose of preventing, diagnosing or treating a sickness, injury, disease or symptom, and

meet certain established criteria. If eligible for Medicare, Medicare is primary and the medical option described here is secondary. This means that this option

pays the difference between what this option would have paid had it been primary (after deductible and out-of-pocket maximums are met) and the amount

Medicare pays.

2012 Diamond HSA Medical Option

Network Non-Network

Annual Deductible

Employee Only $2,300 $4,600

Employee & Spouse (Individual/Family) $2,300/$3,500 $4,600/$7,000

Employee & Child(ren) (Individual/Family) $2,300/$3,500 $4,600/$7,000

Family (Individual/Family) $2,300/$4,500 $4,600/$9,000

Coinsurance (% paid by plan) Plan pays 90% after Deductible Plan pays 60% of 140% of Medicare

Reimbursement Rate after Deductible (Maximum

Non-Network Reimbursement Program (MNRP)

rate (also called the Medicare Reimbursement

Rate). A Medicare-allowable charge is what the

federal Medicare program would allow as a

covered expense).

Annual Coinsurance Maximum (Includes Behavioral Health/Substance Abuse and Prescription Drug Benefits; Excludes the Deductible)

Employee Only $500 $4,600

Employee & Spouse (Individual/Family) $500/$1,000 $4,600/$7,000

Employee & Child(ren) (Individual/Family) $500/$1,000 $4,600/$7,000

Family (Individual/Family) $500/$1,500 $4,600/$9,000

Annual Pharmacy Maximum None None

Pharmacy Benefit Once the annual deductible has been met,

prescriptions are paid at 90% of the Network

Charge (as part of the medical benefit)

Once the annual deductible has been met,

prescriptions are paid at 60% of R&C (as part of

the medical benefit)

Note - Although determination of whether a provider is a Network or Non-Network provider will be made at the time the provider renders the service, the

level of benefits shall be those outlined above. For example, if in 2019, Executive seeks services from a provider who is then a Network provider, but who in

2012 is a Non-Network provider, the benefits noted under the “Network” column shall be provided. Conversely, if in 2019, Executive seeks services from a

provider who is then a Non-Network provider, but who in 2012 is a Network Provider, the benefits noted under the Non-Network column shall be provided.

Provided however, in any event, the Medicare Reimbursement Rate to be used for purposes of determining the level of the Non-Network benefit shall be the

Medicare Reimbursement Rate at the date the service is provided.