Delta Airlines 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

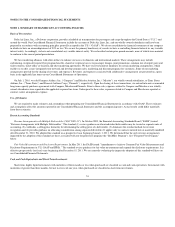

Interest Rate Risk

Our exposure to market risk from adverse changes in interest rates is primarily associated with our long-term debt obligations. Market risk associated with

our fixed and variable rate long-term debt relates to the potential reduction in fair value and negative impact to future earnings, respectively, from an increase

in interest rates.

At December 31, 2011, we had $7.7 billion of fixed-rate long-term debt and $6.1 billion of variable-rate long-term debt. An increase of 100 basis points in

average annual interest rates would have decreased the estimated fair value of our fixed-rate long-term debt by $300 million at December 31, 2011 and would

have increased the annual interest expense on our variable-rate long-term debt by $40 million, inclusive of the impact of our interest rate hedge contracts.

Foreign Currency Exchange Risk

We are subject to foreign currency exchange rate risk because we have revenue and expense denominated in foreign currencies with our primary

exposures being the Japanese yen and Canadian dollar. To manage exchange rate risk, we execute both our international revenue and expense transactions in

the same foreign currency to the extent practicable. From time to time, we may also enter into foreign currency option and forward contracts. At

December 31, 2011, we had open foreign currency forward contracts totaling an $89 million liability position. We estimate that a 10% increase or decrease in

the price of the Japanese yen and Canadian dollar in relation to the U.S. dollar would change the projected cash settlement value of our open hedge contracts

by a $90 million gain or $110 million loss, respectively, for the year ending December 31, 2012.

44