Delta Airlines 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

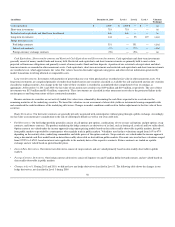

We value goodwill and identified intangible assets primarily using market capitalization and income approach valuation techniques. These measurements

include the following significant unobservable inputs: (1) our projected revenues, expenses and cash flows, (2) an estimated weighted average cost of capital,

(3) assumed discount rates depending on the asset and (4) a tax rate. These assumptions are consistent with those hypothetical market participants would use.

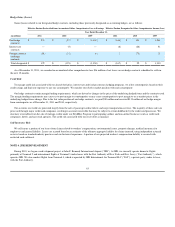

Since we are required to make estimates and assumptions when evaluating goodwill and indefinite-lived intangible assets for impairment, the actual amounts

may differ materially from these estimates.

Changes in assumptions or circumstances could result in impairment. Factors which could cause impairment include, but are not limited to, (1) negative

trends in our market capitalization, (2) an increase in fuel prices, (3) declining passenger mile yields, (4) lower passenger demand as a result of the weakened

U.S. and global economy, (5) interruption to our operations due to an employee strike, terrorist attack, or other reasons, (6) changes to the regulatory

environment and (7) consolidation of competitors in the airline industry.

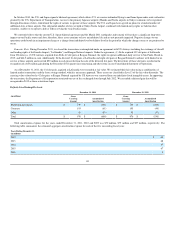

Goodwill. As of December 31, 2011 and 2010, our goodwill balance was $9.8 billion. In evaluating goodwill for impairment, we estimate the fair value of

our reporting unit by considering market capitalization and other factors if it is more likely than not that the fair value of our reporting unit is less than its

carrying value. If the reporting unit's fair value exceeds its carrying value, no further testing is required. If, however, the reporting unit's carrying value

exceeds its fair value, we then determine the amount of the impairment charge, if any. We recognize an impairment charge if the carrying value of the

reporting unit's goodwill exceeds its estimated fair value.

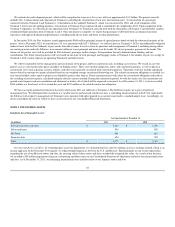

Identifiable Intangible Assets. Our identifiable intangible assets had a net carrying amount of $4.8 billion at December 31, 2011 . Indefinite-lived assets

are not amortized and consist primarily of routes, slots, the Delta tradename and assets related to SkyTeam. Definite-lived intangible assets consist primarily

of marketing agreements and contracts and are amortized on a straight-line basis or under the undiscounted cash flows method over the estimated economic

life of the respective agreements and contracts. Costs incurred to renew or extend the term of an intangible asset are expensed as incurred.

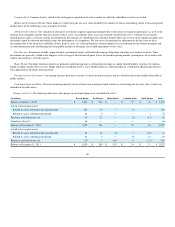

We perform the impairment test for indefinite-lived intangible assets by comparing the asset's fair value to its carrying value. Fair value is estimated based

on (1) recent market transactions, where available, (2) the lease savings method for certain airport slots (which reflects potential lease savings from owning

the slots rather than leasing them from another airline at market rates), (3) the royalty method for the Delta tradename (which assumes hypothetical royalties

generated from using our tradename) or (4) projected discounted future cash flows. We recognize an impairment charge if the asset's carrying value exceeds

its estimated fair value.

Income Taxes

We account for deferred income taxes under the liability method. We recognize deferred tax assets and liabilities based on the tax effects of temporary

differences between the financial statement and tax bases of assets and liabilities, as measured by current enacted tax rates. Deferred tax assets and liabilities

are recorded net as current and noncurrent deferred income taxes. A valuation allowance is recorded to reduce deferred tax assets when necessary. For

additional information about our valuation allowance, see Note 11.

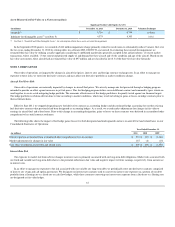

Manufacturers' Credits

We periodically receive credits in connection with the acquisition of aircraft and engines. These credits are deferred until the aircraft and engines are

delivered, and then applied on a pro rata basis as a reduction to the cost of the related equipment.

Maintenance Costs

We record maintenance costs to aircraft maintenance materials and outside repairs. Maintenance costs are expensed as incurred, except for costs incurred

under power-by-the-hour contracts, which are expensed based on actual hours flown. Power-by-the-hour contracts transfer certain risk to third party service

providers and fix the amount we pay per flight hour to the service provider in exchange for maintenance and repairs under a predefined maintenance program.

Modifications that enhance the operating performance or extend the useful lives of airframes or engines are capitalized and amortized over the remaining

estimated useful life of the asset or the remaining lease term, whichever is shorter.

56