Delta Airlines 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Senior Second Lien Notes

In conjunction with the issuance of the Senior Secured Notes, we issued $600 million principal amount of Senior Second Lien Notes that mature in March

2015. We may redeem some or all of the Senior Second Lien Notes on or after March 15, 2012 at specified redemption prices. If we sell certain of our assets

or if we experience specific kinds of changes in control, we must offer to repurchase the Senior Second Lien Notes. During 2010, we repurchased in a cash

tender offer $171 million principal amount of Senior Second Lien Notes.

Our obligations under the Senior Second Lien Notes are guaranteed by the Guarantors, and our obligations and the related guarantees are secured on a

junior basis by security interests in the Pacific Collateral. The Senior Second Lien Notes include default provisions that are substantially similar to the ones

described under “Senior Secured Notes due 2014” above. For a discussion of related financial covenants, see "Key Financial Covenants" below.

Key Financial Covenants

Our secured debt instruments discussed above include affirmative, negative and financial covenants that restrict our ability to, among other things, make

investments, sell or otherwise dispose of collateral if we are not in compliance with the collateral coverage ratio tests described below, pay dividends or

repurchase stock. We were in compliance with all covenants in our financing agreements at December 31, 2011. The financial covenants require us to

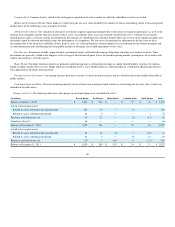

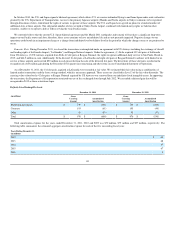

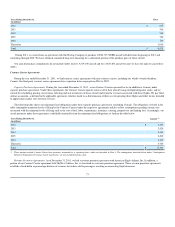

maintain the minimum levels shown in the table below:

Senior Secured Credit

Facilities Senior Secured Pacific

Facilities Senior Secured Notes Senior Second Lien

Notes

Minimum Fixed Charge Coverage Ratio (1) 1.20:1 1.20:1 n/a n/a

Minimum Unrestricted Liquidity

Unrestricted cash and permitted investments $1.0 billion n/a n/a n/a

Unrestricted cash, permitted investments, and

undrawn revolving credit facilities

$2.0 billion $2.0 billion n/a n/a

Minimum Collateral Coverage Ratio (2) 1.67:1 (3) 1.60:1 1.60:1 1.00:1

(1) Defined as the ratio of (a) earnings before interest, taxes, depreciation, amortization and aircraft rent, and other adjustments to net income to (b) the sum of gross cash interest expense

(including the interest portion of our capitalized lease obligations) and cash aircraft rent expense, for the 12-month period ending as of the last day of each fiscal quarter.

(2) Defined as the ratio of (a) certain of the collateral that meets specified eligibility standards to (b) the sum of the aggregate outstanding obligations and certain other obligations.

(3) Excluding the non-Pacific international routes from the collateral for purposes of the calculation, the required minimum collateral coverage ratio is 0.75:1

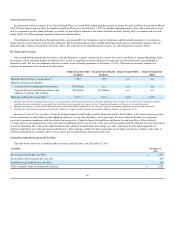

Minimum Collateral Coverage Ratio. Under the Senior Secured Credit Facilities and the Senior Secured Pacific Facilities, if the collateral coverage ratios

are not maintained, we must either provide additional collateral to secure our obligations, or we must repay the loans under the facilities by an amount

necessary to maintain compliance with the collateral coverage ratios. Under the Senior Secured Notes and Senior Second Lien Notes, if the collateral

coverage ratios are not maintained, we must generally pay additional interest on the notes at the rate of 2% per annum until the collateral coverage ratio equals

at least the minimum. The value of the collateral that has been pledged in each facility may change over time, which may be reflected in appraisals of

collateral required by our credit agreements and indentures. These changes could result from factors that are not under our control. A decline in the value of

collateral could result in a situation where we may not be able to maintain the collateral coverage ratio.

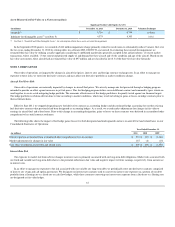

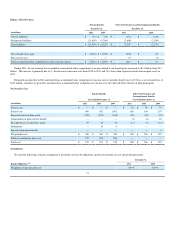

Availability Under Revolving Credit Facilities

The table below shows our availability under revolving credit facilities as of December 31, 2011:

(in millions) December 31,

2011

Revolving Credit Facility, due 2016 $ 1,225

Pacific Routes Revolving Facility, due 2013 500

Bank Revolving Credit Facility, due 2012 100

Total availability under revolving credit facilities $ 1,825

69