Delta Airlines 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

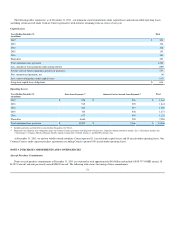

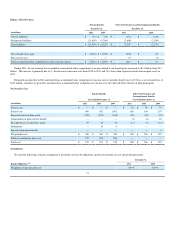

The Senior Secured Credit Facilities contain events of default customary for similar financings, including cross-defaults to other material indebtedness

and certain change of control events. The Senior Secured Credit Facilities also include events of default specific to our business, including the suspension of

all or substantially all of our flights and operations for more than five consecutive days (other than as a result of a Federal Aviation Administration suspension

due to extraordinary events similarly affecting other major U.S. air carriers). Upon the occurrence of an event of default, the outstanding obligations may be

accelerated and become due and payable immediately. For a discussion of related financial covenants, see "Key Financial Covenants" below.

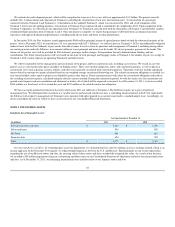

Senior Secured Exit Financing Facilities

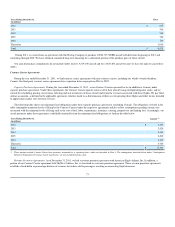

In connection with entering into the Senior Secured Credit Facilities, we retired the outstanding loans under our $2.5 billion senior secured exit financing

facilities and terminated those facilities as well as an existing undrawn $100 million revolving credit facility. These retired senior secured exit financing

facilities consisted of:

• $914 million first-lien revolving credit facility and an $86 million first-lien term loan due April 2012;

• $600 million first-lien synthetic revolving facility due April 2012 ; and

• $900 million second-lien term loan facility due April 2014.

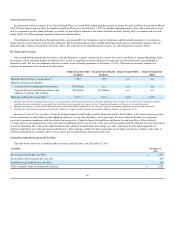

Senior Secured Pacific Facilities

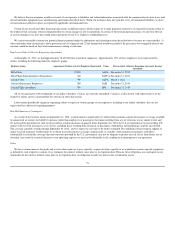

In 2009, we entered into a first-lien term loan facility in the aggregate principal amount of $250 million (the “Pacific Routes Term Facility”) and a first-

lien revolving credit facility in the aggregate principal amount of $500 million (the “Pacific Routes Revolving Facility”), collectively the “Senior Secured

Pacific Facilities.” The Senior Secured Pacific Facilities are guaranteed by the Guarantors and are secured by a first lien on our Pacific route authorities and

certain related assets (the “Pacific Collateral”). Lenders under the Senior Secured Pacific Facilities and holders of the Senior Secured Notes (described below)

have equal rights to payment and the Pacific Collateral.

During 2011, we refinanced and amended the Pacific Routes Term Facility to, among other things, (1) reduce the interest rate, (2) extend the maturity date

from September 2013 to March 2016 and (3) modify certain negative covenants and default provisions to be substantially similar to those described above

under “Senior Secured Credit Facilities.”

Borrowings under the Pacific Routes Term Facility must be repaid in an amount equal to 1% of the original principal amount of the term loans annually

(to be paid in equal quarterly installments), with the balance due in March 2016 . Borrowings under the Pacific Routes Revolving Facility are due in March

2013 and can be repaid and reborrowed without penalty. As of December 31, 2011 , the Pacific Routes Revolving Facility was undrawn.

The Senior Secured Pacific Facilities contain mandatory prepayment provisions that require us in certain instances to prepay obligations under the Senior

Secured Pacific Facilities in connection with dispositions of collateral. For a discussion of related financial covenants, see "Key Financial Covenants" below.

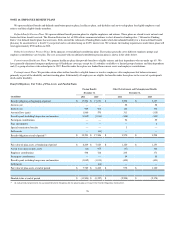

Senior Secured Notes

In 2009, we issued $750 million principal amount of Senior Secured Notes that mature in September 2014. We may redeem some or all of these notes at

specified redemption prices. If we sell certain of our assets or if we experience specific kinds of changes in control, we must offer to repurchase the Senior

Secured Notes. During 2011, we voluntarily redeemed $75 million principal amount of Senior Secured Notes. We also voluntarily redeemed $75 million

principal amount of Senior Secured Notes in 2010.

The Senior Secured Notes are guaranteed by the Guarantors and are secured by the Pacific Collateral. Holders of the Senior Secured Notes and lenders

under the Senior Secured Pacific Facilities (discussed above) have equal rights to payment and collateral.

The Senior Secured Notes contain events of default customary for similar financings, including cross-defaults to other material indebtedness. Upon the

occurrence of an event of default, the outstanding obligations may be accelerated and become due and payable immediately. For a discussion of related

financial covenants, see "Key Financial Covenants" below.

68