Cricket Wireless 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

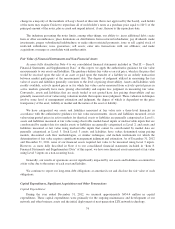

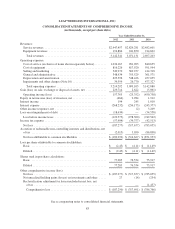

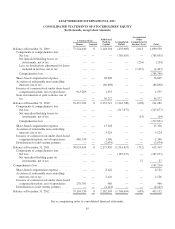

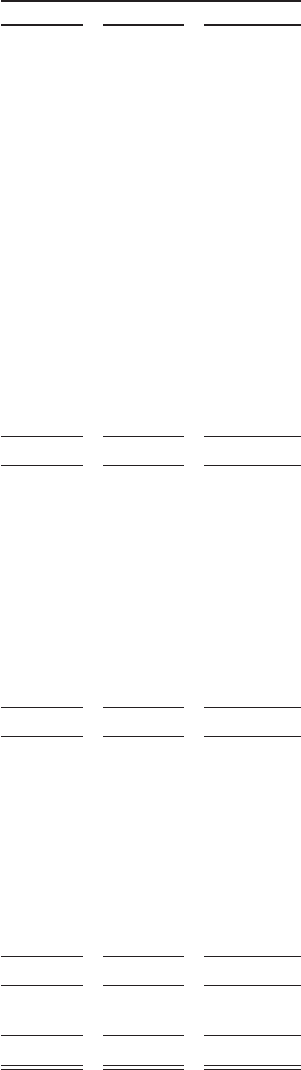

LEAP WIRELESS INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

Year Ended December 31,

2012 2011 2010

Operating activities:

Net loss .................................................. $(187,277) $(317,677) $ (785,055)

Adjustments to reconcile net loss to net cash provided by operating

activities:

Share-based compensation expense .......................... 8,122 15,328 36,609

Depreciation and amortization .............................. 625,596 548,426 457,035

Accretion of asset retirement obligations ...................... 3,208 3,061 2,503

Non-cash interest items, net ................................ 13,514 13,178 11,446

Non-cash (gain) loss on extinguishment of debt ................. 3,528 — (2,040)

Deferred income tax expense ............................... 53,845 35,316 39,263

Impairments and other charges .............................. 13,640 377 477,327

(Gain) loss on sale, exchange or disposal of assets, net ........... (229,714) (2,732) 5,061

Equity in net (income) loss of investees, net of cash dividends ..... 464 3,628 (1,912)

Changes in assets and liabilities:

Inventories and deferred charges .......................... (7,628) (23,352) (2,469)

Other assets ........................................... (9,735) (40,970) (16,791)

Accounts payable and accrued liabilities .................... (64,079) 87,668 63,120

Other liabilities ........................................ (53,989) 43,212 28,181

Impairments and other charges, to be settled in cash ........... 12,950 22,046 —

Net cash provided by operating activities .................... 182,445 387,509 312,278

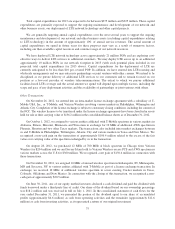

Investing activities:

Acquisition of a business .................................... — (850) (40,730)

Purchases of property and equipment ........................... (434,395) (441,656) (398,894)

Change in prepayments for purchases of property and equipment ..... (1,940) (9,944) 1,412

Purchases of wireless licenses and spectrum clearing costs .......... (5,596) (4,880) (13,319)

Proceeds from sales of wireless licenses and operating assets, net .... 154,068 5,070 —

Purchases of investments .................................... (367,487) (826,233) (488,450)

Sales and maturities of investments ............................ 613,632 487,860 816,247

Purchase of membership units of equity investment ................ — — (967)

Dividend received from equity investee ......................... — 11,606 —

Change in restricted cash .................................... 239 (948) 749

Net cash used in investing activities ........................ (41,479) (779,975) (123,952)

Financing activities:

Proceeds from the issuance of long-term debt .................... 396,000 396,772 1,179,876

Repayment of long-term debt ................................. (321,911) (23,589) (1,118,096)

Payment of debt issuance costs ................................ (5,645) (7,269) (1,308)

Purchase of non-controlling interest ............................ (5,250) — (77,664)

Non-controlling interest contribution ........................... — — 5,100

Proceeds from issuance of common stock, net .................... 959 1,346 1,535

Proceeds from sale lease-back financing ........................ — 25,815 —

Payments made to joint venture partners ........................ (29,407) (3,108) —

Other .................................................... (5,405) (3,048) (1,978)

Net cash provided by (used in) financing activities ............ 29,341 386,919 (12,535)

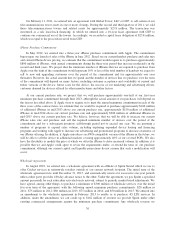

Net increase (decrease) in cash and cash equivalents ................. 170,307 (5,547) 175,791

Cash and cash equivalents at beginning of period ................... 345,243 350,790 174,999

Cash and cash equivalents at end of period ........................ $515,550 $ 345,243 $ 350,790

See accompanying notes to consolidated financial statements.

84