Cricket Wireless 2012 Annual Report Download - page 76

Download and view the complete annual report

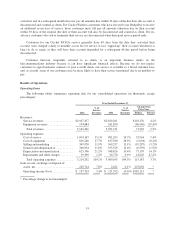

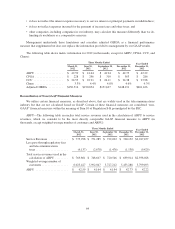

Please find page 76 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.subject to adjustments that have the effect of including amounts, which are excluded from the most directly

comparable measure so calculated and presented. See “Reconciliation of Non-GAAP Financial Measures” below

for a reconciliation of ARPU, CPGA, CCU and adjusted OIBDA to the most directly comparable GAAP

financial measures.

ARPU is service revenues, less pass-through regulatory fees and telecommunications taxes, divided by the

weighted-average number of customers, divided by the number of months during the period being measured.

Management uses ARPU to identify average revenue per customer, to track changes in average customer

revenues over time, to help evaluate how changes in our business, including changes in our service offerings,

affect average revenue per customer, and to forecast future service revenue. In addition, ARPU provides

management with a useful measure to compare our subscriber revenue to that of other wireless communications

providers. Our customers are generally disconnected from service after a specified period following their failure

to either pay a monthly bill or replenish, or “top-up,” their account. Because our calculation of weighted-average

number of customers includes customers who are not currently paying for service but who have not yet been

disconnected from service because they have not paid their last bill or have not replenished their account, ARPU

may appear lower during periods in which we have significant disconnect activity. We believe investors use

ARPU primarily as a tool to track changes in our average revenue per customer and to compare our per customer

service revenues to those of other wireless communications providers. Other companies may calculate this

measure differently.

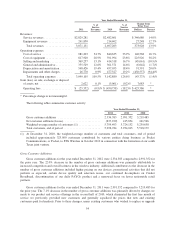

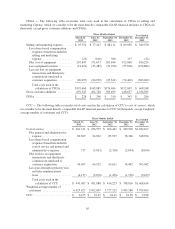

CPGA is selling and marketing costs (excluding applicable share-based compensation expense or benefit

included in selling and marketing expense), and equipment subsidy (generally defined as cost of equipment less

equipment revenue), less the net loss on equipment transactions and third-party commissions unrelated to

customer acquisition, divided by the total number of gross new customer additions during the period being

measured. The net loss on equipment transactions unrelated to customer acquisition includes the revenues and

costs associated with the sale of wireless devices to existing customers as well as costs associated with device

replacements and repairs (other than warranty costs, which are the responsibility of the device manufacturers).

Third-party commissions unrelated to customer acquisition are commissions paid to third parties for certain

activities related to the continuing service of customers. We deduct customers who do not pay the first bill they

receive following initial activation from our gross customer additions in the month in which they are

disconnected, which tends to increase CPGA because we incur the costs associated with a new customer without

receiving the benefit of a gross customer addition. Management uses CPGA to measure the efficiency of our

customer acquisition efforts, to track changes in our average cost of acquiring new subscribers over time, and to

help evaluate how changes in our sales and distribution strategies affect the cost-efficiency of our customer

acquisition efforts. In addition, CPGA provides management with a useful measure to compare our per customer

acquisition costs with those of other wireless communications providers. We believe investors use CPGA

primarily as a tool to track changes in our average cost of acquiring new customers and to compare our per

customer acquisition costs to those of other wireless communications providers. Other companies may calculate

this measure differently.

CCU is cost of service and general and administrative costs (excluding applicable share-based compensation

expense or benefit included in cost of service and general and administrative expense) plus net loss on equipment

transactions and third-party commissions unrelated to customer acquisition (which includes the gain or loss on

the sale of devices to existing customers, costs associated with device replacements and repairs (other than

warranty costs which are the responsibility of the device manufacturers) and commissions paid to third parties for

certain activities related to the continuing service of customers), less pass-through regulatory fees and

telecommunications taxes, divided by the weighted-average number of customers, divided by the number of

months during the period being measured. CCU does not include any depreciation and amortization expense.

Management uses CCU as a tool to evaluate the non-selling cash expenses associated with ongoing business

operations on a per customer basis, to track changes in these non-selling cash costs over time, and to help

evaluate how changes in our business operations affect non-selling cash costs per customer. In addition, CCU

provides management with a useful measure to compare our non-selling cash costs per customer with those of

62