Cricket Wireless 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

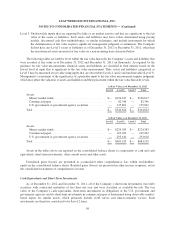

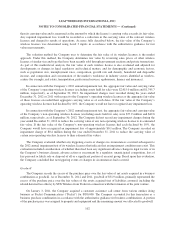

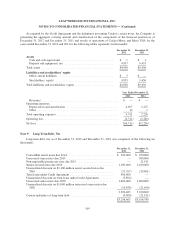

The following table summarizes the changes in the carrying amount of the Company’s goodwill during the

years ended December 31, 2012 and December 31, 2011 (in thousands):

Year Ended December 31,

2012 2011

Beginning balance, January 1 ...................................... $31,886 $31,094

Goodwill acquired ............................................. — 560

Goodwill resulting from final Pocket purchase price adjustments ........ — 232

Ending balance, December 31 ...................................... $31,886 $31,886

During the third quarter of each year, the Company assesses its goodwill for impairment at the reporting unit

level by applying a fair value test. This fair value test involves a two-step process. The first step is to compare the

carrying value of the Company’s net assets to its fair value. If the fair value is determined to be less than carrying

value, a second step is performed to measure the amount of the impairment, if any.

Significant judgments are required in connection with the Company’s annual impairment test in order to

estimate its fair value. The Company has generally based its determination of fair value primarily upon its

average market capitalization for the month of August plus a control premium. Average market capitalization is

calculated based upon the average number of shares of Leap common stock outstanding during such month and

the average closing price of Leap common stock during such month. The Company considered the month of

August to be an appropriate period over which to measure average market capitalization in 2012 because trading

prices during that period reflected market reaction to the Company’s most recently announced financial and

operating results, announced early in the month of August.

In conducting the annual impairment test during the third quarter of 2012, the Company applied a control

premium of 30% to its average market capitalization. The Company believes that consideration of a control

premium is customary in determining fair value and is contemplated by the applicable accounting guidance. The

Company believes that its consideration of a control premium was appropriate because it believes that its market

capitalization does not fully capture the fair value of its business as a whole or the additional amount an assumed

purchaser would pay to obtain a controlling interest in the Company. The Company determined the amount of the

control premium as part of its third quarter 2012 testing based upon relevant transactional experience and an

assessment of market, economic and other factors. Depending on the circumstances, the actual amount of any

control premium realized in any transaction involving the Company could be higher or lower than the control

premium the Company applied.

The carrying value of the Company’s goodwill was $31.9 million as of August 31, 2012. Based upon its

annual impairment test conducted during the third quarter of 2012, the book value of the Company’s net assets as

of August 31, 2012 was $527.5 million and the fair value of the Company, based upon its average market

capitalization during the month of August and an assumed control premium of 30%, was $573.5 million. As

such, the Company determined that no impairment condition existed and was not required to perform the second

step of the goodwill impairment test.

In the fourth quarter of 2012, the Company evaluated whether any triggering events or changes in

circumstances had occurred subsequent to the annual impairment test conducted in the third quarter of 2012. As

part of this evaluation, the Company considered whether there were any events or circumstances that would

indicate it was more likely than not that the carrying value of the Company exceeded its fair value. Based on this

evaluation, the Company determined that the $106.4 million gain resulting from the spectrum swap with T-

Mobile, which closed on October 1, 2012, constituted a triggering event due to the significant increase in the

103