Cricket Wireless 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Credit Agreement, Leap, Cricket and the guarantors are permitted to incur liens securing indebtedness for

borrowed money in an aggregate principal amount outstanding (including the aggregate principal amount

outstanding of the 7.75% senior secured notes due 2016) of up to the greater of $1,750 million and 3.5 times

Leap’s consolidated cash flow (excluding the consolidated cash flow of Cricket Music) for the prior four fiscal

quarters.

Borrowings under the Credit Agreement are effectively junior to all of Leap’s, Cricket’s and the guarantors’

obligations under any permitted priority debt that may be incurred in the future (up to the lesser of 0.30 times

Leap’s consolidated cash flow (excluding the consolidated cash flow of STX Wireless and Cricket Music) for the

prior four fiscal quarters and $300 million in aggregate principal amount outstanding), to the extent of the value

of the collateral securing such permitted priority debt, as well as to existing and future liabilities of Leap’s and

Cricket’s subsidiaries that are not guarantors (including STX Wireless and Cricket Music and their respective

subsidiaries). In addition, borrowings under the Credit Agreement are senior in right of payment to any of

Leap’s, Cricket’s and the guarantors’ future subordinated indebtedness.

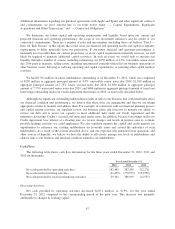

Cricket has the right to prepay borrowings under the Credit Agreement, in whole or in part, at any time

without premium or penalty, except that prepayments in connection with a repricing transaction occurring on or

prior to October 10, 2013 are subject to a prepayment premium of 1.00% of the principal amount of the

borrowings so prepaid.

Under the Credit Agreement, Leap and its restricted subsidiaries are subject to certain limitations, including

limitations on their ability to: incur additional debt or sell assets, make certain investments, grant liens and pay

dividends and make certain other restricted payments. In addition, Cricket will be required to pay down the

facility under certain circumstances if Leap and its restricted subsidiaries issue debt, sell assets or property,

receive certain extraordinary receipts or generate excess cash flow (as defined in the Credit Agreement).

The Credit Agreement also provides for an event of default upon the occurrence of a change of control,

which includes the acquisition of beneficial ownership of 35% or more of Leap’s equity securities (other than a

transaction where immediately after such transaction Leap will be a wholly owned subsidiary of a person of

which no person or group is the beneficial owner of 35% or more of such person’s voting stock), a sale of all or

substantially all of the assets of Leap and its restricted subsidiaries and a change in a majority of the members of

Leap’s board of directors that is not approved by the board. If the indebtedness under the Credit Agreement was

accelerated prior to maturity as a result of such change of control, this would give rise to an event of default

under the indentures governing our secured and unsecured senior notes and convertible notes.

Senior Notes

Discharge of Indenture and Loss on Extinguishment of Debt

On October 10, 2012, in connection with our entry into the Credit Agreement, we issued a notice of

redemption to redeem all of our 10% unsecured senior notes due 2015 in accordance with the optional

redemption provisions governing the notes at a redemption price of 105% of the principal amount of outstanding

notes, plus accrued and unpaid interest to the redemption date. On November 9, 2012, we completed the

redemption for a total cash payment of $324.5 million and the indenture governing the notes was satisfied and

discharged in accordance with its terms. As a result of this redemption, we recognized a $18.6 million loss on

extinguishment of debt during the year ended December 31, 2012, which was comprised of $15.0 million in

redemption premium, $3.5 million in unamortized debt issuance costs and $0.1 million in professional fees.

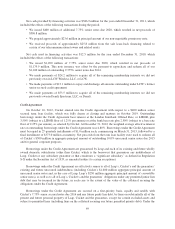

Discharge of Non-Negotiable Promissory Note Due 2015

Cricket service was previously offered in greater Chicago and Southern Wisconsin by Denali, an entity in

which the Company previously owned an 82.5% non-controlling membership interest. In December 2010,

Cricket purchased the remaining 17.5% controlling membership interest in Denali that it did not previously own.

70