Cricket Wireless 2012 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

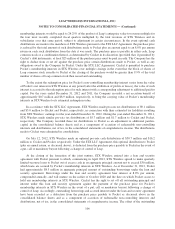

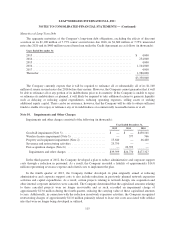

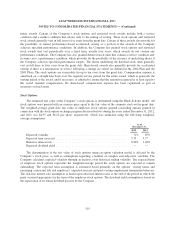

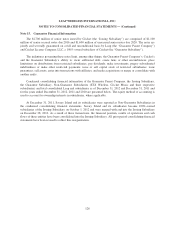

The following table provides a rollforward of the impairments and other charges recorded as a component of

accounts payable and accrued liabilities within the consolidated balance sheets:

December 31,

2011 Accruals Payments

December 31,

2012

Post acquisition charges ................. $22,046 $ — $ (7,320) $14,726

Severance ............................ — 14,753 (4,876) 9,877

Restructuring activities .................. — 11,006 (613) 10,393

Total impairments and other charges, to be

settled in cash ......................... $22,046 $25,759 $(12,809) $34,996

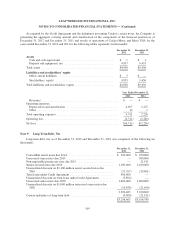

Note 11. Income Taxes

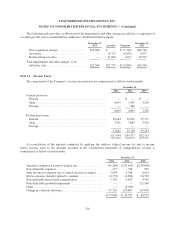

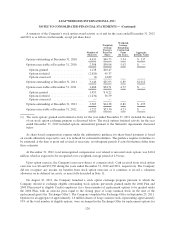

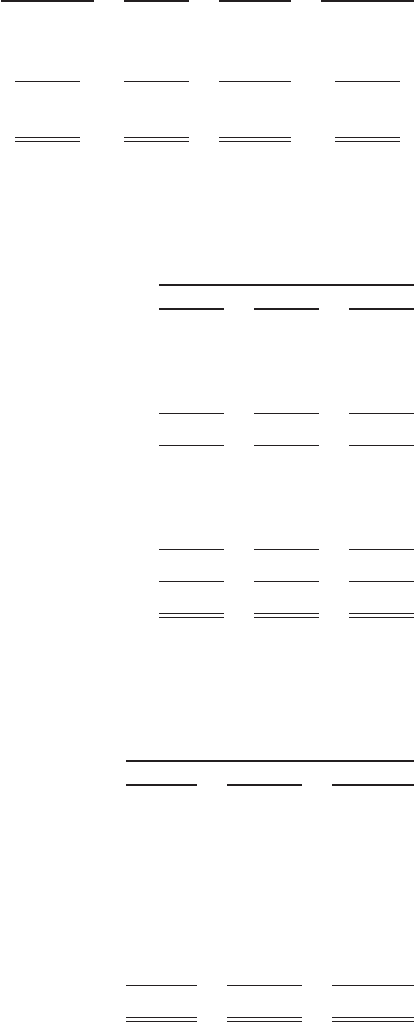

The components of the Company’s income tax provision are summarized as follows (in thousands):

December 31,

2012 2011 2010

Current provision:

Federal .............................................. — $ — $ —

State ................................................ 4,059 3,595 3,250

Foreign .............................................. — 466 —

4,059 4,061 3,250

Deferred provision:

Federal .............................................. 50,544 32,229 35,337

State ................................................ 3,301 3,087 3,926

Foreign ..............................................———

53,845 35,316 39,263

$57,904 $39,377 $42,513

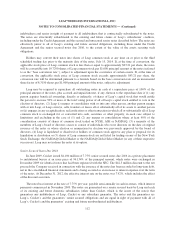

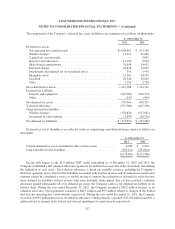

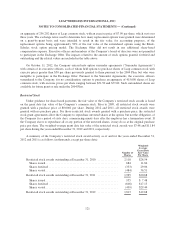

A reconciliation of the amounts computed by applying the statutory federal income tax rate to income

before income taxes to the amounts recorded in the consolidated statements of comprehensive income is

summarized as follows (in thousands):

December 31,

2012 2011 2010

Amounts computed at statutory federal rate ................ (45,280) $ (97,405) $(259,890)

Non-deductible expenses ............................... 477 376 505

State income tax expense, net of federal income tax impact .... 5,944 5,708 6,019

Net tax expense (benefit) related to ventures ............... (6,737) (2,856) 18,352

Non-deductible share-based compensation ................. 5,776 6,623 4,505

Non-deductible goodwill impairment ..................... — — 125,164

Other .............................................. — (2,936) —

Change in valuation allowance .......................... 97,724 129,867 147,858

$ 57,904 $ 39,377 $ 42,513

116