Cricket Wireless 2012 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

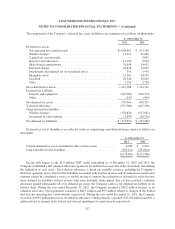

future awards. Certain of the Company’s stock options and restricted stock awards include both a service

condition and a market condition that relates only to the timing of vesting. These stock options and restricted

stock awards generally vest in full four to five years from the grant date. Certain of these awards also provide for

the possibility of annual performance-based accelerated vesting of a portion of the awards if the Company

achieves specified performance conditions. In addition, the Company has granted stock options and restricted

stock awards that vest periodically over a fixed term, usually four years, which awards do not contain any

performance conditions. The Company has also granted deferred stock units that contain a service condition and,

in some cases, a performance condition, which provides for the possibility of the issuance of underlying shares if

the Company achieves specified performance targets. The shares underlying the deferred stock units generally

vest in full three to four years from the grant date. Share-based awards also generally provide for accelerated

vesting if there is a termination of service following a change in control (as defined in the 2004 Plan and the

2009 Plan). The stock options are exercisable for up to ten years from the grant date. Compensation expense is

amortized on a straight-line basis over the requisite service period for the entire award, which is generally the

vesting period of the award, and if necessary, is adjusted to ensure that the amount recognized is at least equal to

the vested (earned) compensation. No share-based compensation expense has been capitalized as part of

inventory or fixed assets.

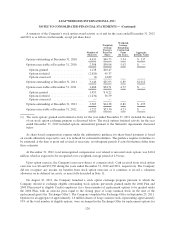

Stock Options

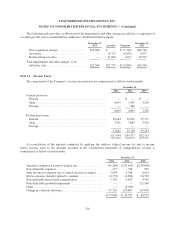

The estimated fair value of the Company’s stock options is determined using the Black-Scholes model. All

stock options were granted with an exercise price equal to the fair value of the common stock on the grant date.

The weighted-average grant date fair value of employee stock options granted (excluding options granted in

connection with the stock option exchange program discussed below) during the years ended December 31, 2012,

and 2011 was $4.95 and $6.22 per share, respectively, which was estimated using the following weighted-

average assumptions:

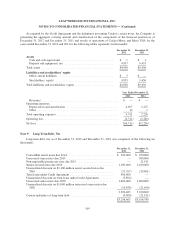

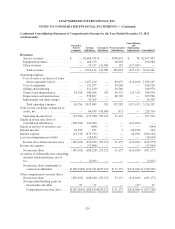

As of

December 31,

2012 2011

Expected volatility .................................................... 71% 65%

Expected term (in years) ............................................... 5.75 5.77

Risk-free interest rate .................................................. 0.90% 1.04%

Expected dividend yield ................................................ — —

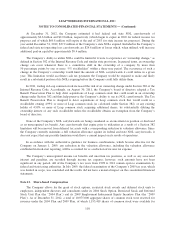

The determination of the fair value of stock options using an option valuation model is affected by the

Company’s stock price, as well as assumptions regarding a number of complex and subjective variables. The

Company calculates expected volatility through an analysis of its historical trading volatility. The expected term

of employee stock options represents the weighted-average period the stock options are expected to remain

outstanding. The expected term assumption is estimated based primarily on the options’ vesting terms and

remaining contractual life and employees’ expected exercise and post-vesting employment termination behavior.

The risk-free interest rate assumption is based upon observed interest rates at the end of the period in which the

grant occurred appropriate for the term of the employee stock options. The dividend yield assumption is based on

the expectation of no future dividend payouts by the Company.

119