Cricket Wireless 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

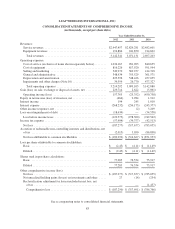

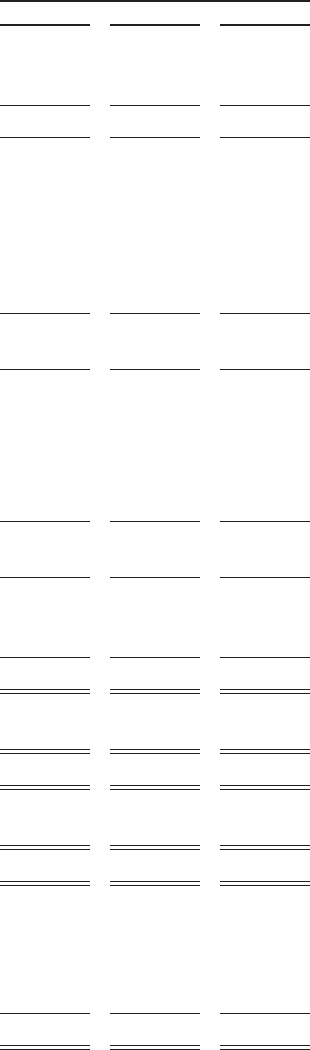

LEAP WIRELESS INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands, except per share data)

Year Ended December 31,

2012 2011 2010

Revenues:

Service revenues .......................................... $2,947,457 $2,829,281 $2,482,601

Equipment revenues ....................................... 194,884 241,850 214,602

Total revenues .......................................... 3,142,341 3,071,131 2,697,203

Operating expenses:

Cost of service (exclusive of items shown separately below) ........ 1,034,167 981,203 840,635

Cost of equipment ......................................... 816,226 817,920 591,994

Selling and marketing ...................................... 349,970 369,257 414,318

General and administrative .................................. 348,934 355,529 361,571

Depreciation and amortization ............................... 625,596 548,426 457,035

Impairments and other charges (Note 10) ....................... 39,399 26,770 477,327

Total operating expenses .................................. 3,214,292 3,099,105 3,142,880

Gain (loss) on sale, exchange or disposal of assets, net .............. 229,714 2,622 (5,061)

Operating income (loss) .................................... 157,763 (25,352) (450,738)

Equity in net income (loss) of investees, net ....................... (464) 2,984 1,912

Interest income ............................................. 194 245 1,010

Interest expense ............................................. (268,232) (256,175) (243,377)

Other income (expense), net ................................... — (2) 3,209

Loss on extinguishment of debt ................................ (18,634) — (54,558)

Loss before income taxes ................................... (129,373) (278,300) (742,542)

Income tax expense .......................................... (57,904) (39,377) (42,513)

Net loss ................................................. (187,277) (317,677) (785,055)

Accretion of redeemable non-controlling interests and distributions, net

oftax ................................................... (2,015) 3,050 (86,898)

Net loss attributable to common stockholders ................... $ (189,292) $ (314,627) $ (871,953)

Loss per share attributable to common stockholders:

Basic ................................................... $ (2.45) $ (4.11) $ (11.49)

Diluted .................................................. $ (2.45) $ (4.11) $ (11.49)

Shares used in per share calculations:

Basic ................................................... 77,283 76,534 75,917

Diluted .................................................. 77,283 76,534 75,917

Other comprehensive income (loss):

Net loss ................................................. $ (187,277) $ (317,677) $ (785,055)

Net unrealized holding gains (losses) on investments and other ..... 27 (14) (254)

Reclassification adjustment for losses included in net loss, net

oftax ................................................. — — (1,457)

Comprehensive loss ...................................... $ (187,250) $ (317,691) $ (786,766)

See accompanying notes to consolidated financial statements.

83