Cricket Wireless 2012 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

an aggregate of 256,202 shares of Leap common stock, with an exercise price of $7.09 per share, which vest over

three years. The exchange ratios used to determine how many replacement options were granted were determined

on a grant-by-grant basis and were intended to result in the fair value, for accounting purposes, of the

replacement options being approximately 50% of the fair value of the surrendered options using the Black-

Scholes stock option pricing model. The Exchange Offer did not result in any additional share-based

compensation expense. Executive officers and members of the Company’s board of directors were not permitted

to participate in the Exchange Offer. The impacts related to the amount of stock options granted, forfeited and

outstanding and the related values are included in the table above.

On October 11, 2012, the Company entered into option surrender agreements (“Surrender Agreements”)

with certain of its executive officers, each of whom held options to purchase shares of Leap common stock with

exercise prices greater than $50 per share previously granted to them pursuant to the 2004 Plan, but who were

ineligible to participate in the Exchange Offer. Pursuant to the Surrender Agreements, the executive officers

surrendered to the Company, for no consideration, options to purchase an aggregate of 415,000 shares of Leap

common stock, with exercise prices per share ranging between $51.50 and $79.00. Such surrendered shares are

available for future grant or sale under the 2004 Plan.

Restricted Stock

Under guidance for share-based payments, the fair value of the Company’s restricted stock awards is based

on the grant date fair value of the Company’s common stock. Prior to 2009, all restricted stock awards were

granted with a purchase price of $0.0001 per share. During 2012 and 2011, all restricted stock awards were

granted with no purchase price. For those restricted stock awards granted with a purchase price, the restricted

stock grant agreements allow the Company to repurchase unvested shares at the option, but not the obligation, of

the Company for a period of sixty days, commencing ninety days after the employee has a termination event. If

the Company elects to repurchase all or any portion of the unvested shares, it may do so at the original purchase

price per share. The weighted-average grant date fair value of the restricted stock awards was $7.48 and $11.84

per share during the years ended December 31, 2012 and 2011, respectively.

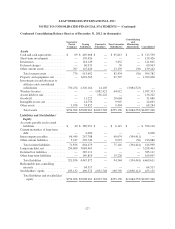

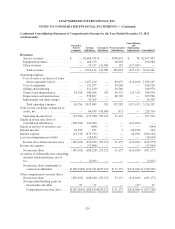

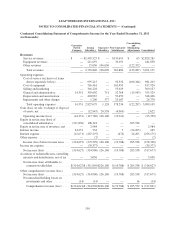

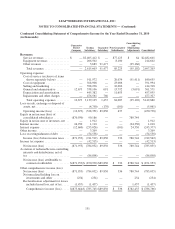

A summary of the Company’s restricted stock award activity as of and for the years ended December 31,

2012 and 2011 is as follows (in thousands, except per share data):

Number of

Shares

Weighted-

Average

Grant Date

Fair Value

Per Share

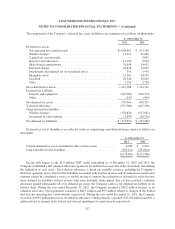

Restricted stock awards outstanding at December 31, 2010 .............. 2,118 $28.54

Shares issued ................................................. 684 11.84

Shares forfeited ............................................... (353) 29.06

Shares vested ................................................. (484) 36.51

Restricted stock awards outstanding at December 31, 2011 .............. 1,965 $20.68

Shares issued ................................................. 955 $ 7.48

Shares forfeited ............................................... (608) $17.13

Shares vested ................................................. (499) $29.44

Restricted stock awards outstanding at December 31, 2012 .............. 1,813 $12.68

121