Cricket Wireless 2012 Annual Report Download - page 140

Download and view the complete annual report

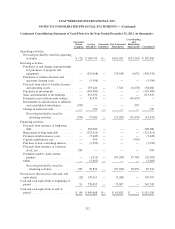

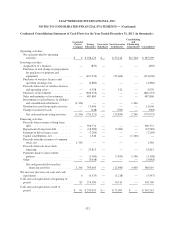

Please find page 140 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LEAP WIRELESS INTERNATIONAL, INC.

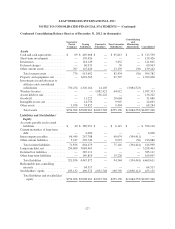

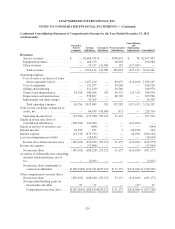

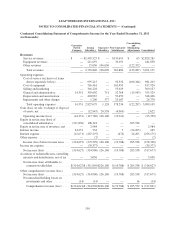

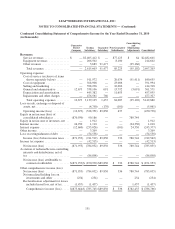

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

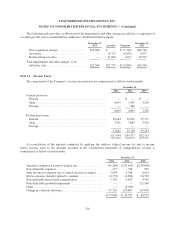

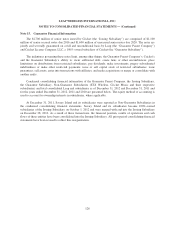

Note 15. Guarantor Financial Information

The $2,700 million of senior notes issued by Cricket (the “Issuing Subsidiary”) are comprised of $1,100

million of senior secured notes due 2016 and $1,600 million of unsecured senior notes due 2020. The notes are

jointly and severally guaranteed on a full and unconditional basis by Leap (the “Guarantor Parent Company”)

and Cricket License Company, LLC, a 100%-owned subsidiary of Cricket (the “Guarantor Subsidiary”).

The indentures governing these notes limit, among other things, the Guarantor Parent Company’s, Cricket’s

and the Guarantor Subsidiary’s ability to: incur additional debt; create liens or other encumbrances; place

limitations on distributions from restricted subsidiaries; pay dividends; make investments; prepay subordinated

indebtedness or make other restricted payments; issue or sell capital stock of restricted subsidiaries; issue

guarantees; sell assets; enter into transactions with affiliates; and make acquisitions or merge or consolidate with

another entity.

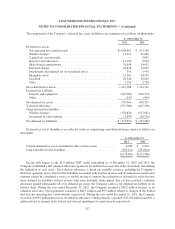

Condensed consolidating financial information of the Guarantor Parent Company, the Issuing Subsidiary,

the Guarantor Subsidiary, Non-Guarantor Subsidiaries (STX Wireless, Cricket Music and their respective

subsidiaries) and total consolidated Leap and subsidiaries as of December 31, 2012 and December 31, 2011 and

for the years ended December 31, 2012, 2011 and 2010 are presented below. The equity method of accounting is

used to account for ownership interests in subsidiaries, where applicable.

At December 31, 2011, Savary Island and its subsidiaries were reported as Non-Guarantor Subsidiaries in

the condensed consolidating financial statements. Savary Island and its subsidiaries became 100%-owned

subsidiaries of the Issuing Subsidiary on October 1, 2012 and were merged with and into the Issuing Subsidiary

on December 28, 2012. As a result of these transactions, the financial position, results of operations and cash

flows of these entities have been consolidated into the Issuing Subsidiary. All prior period consolidating financial

statements have been revised to reflect this reorganization.

126