Cricket Wireless 2012 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Credit Agreement

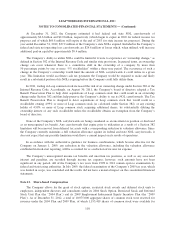

On October 10, 2012, Cricket entered into a credit agreement (the “Credit Agreement”) with respect to a

$400 million senior secured term loan facility, which was fully drawn at closing and matures in October 2019.

Outstanding borrowings under the Credit Agreement bear interest at the London Interbank Offered Rate

(“LIBOR”) plus 3.50% (subject to a LIBOR floor of 1.25% per annum) or at the bank base rate plus 2.50%

(subject to a base rate floor of 2.25% per annum), as selected by Cricket. At December 31, 2012, the weighted

average effective interest rate on outstanding borrowings under the Credit Agreement was 4.80%. Borrowings

under the Credit Agreement must be repaid in 27 quarterly installments of $1.0 million each, commencing on

March 31, 2013, followed by a final installment of $373.0 million at maturity. Net proceeds from the term loan

facility were used to redeem all of Cricket’s $300 million in aggregate principal amount of outstanding 10.0%

unsecured senior notes due 2015 and other general corporate purposes.

Borrowings under the Credit Agreement are guaranteed by Leap and each of its existing and future wholly

owned domestic subsidiaries (other than Cricket, which is the borrower) that guarantees any indebtedness of

Leap, Cricket or any subsidiary guarantor or that constitutes a “significant subsidiary” as defined in Regulation

S-X under the Securities Act of 1933, as amended (subject to certain exceptions).

Borrowings under the Credit Agreement are effectively senior to all of Leap’s, Cricket’s and the guarantors’

existing and future unsecured indebtedness (including Cricket’s $1,600 million aggregate principal amount of

unsecured senior notes and, in the case of Leap, Leap’s $250 million aggregate principal amount of convertible

senior notes), as well as to all of Leap’s, Cricket’s and the guarantors’ obligations under any permitted junior lien

debt that may be incurred in the future, in each case to the extent of the value of the collateral securing the

obligations under the Credit Agreement.

Borrowings under the Credit Agreement are secured on a first-priority basis, equally and ratably with

Cricket’s 7.75% senior secured notes due 2016 and any future parity lien debt, by liens on substantially all of the

present and future personal property of Leap, Cricket and the guarantors, except for certain excluded assets and

subject to permitted liens (including liens on the collateral securing any future permitted priority debt). Under the

Credit Agreement, Leap, Cricket and the guarantors are permitted to incur liens securing indebtedness for

borrowed money in an aggregate principal amount outstanding (including the aggregate principal amount

outstanding of the 7.75% senior secured notes due 2016) of up to the greater of $1,750 million and 3.5 times

Leap’s consolidated cash flow (excluding the consolidated cash flow of Cricket Music Holdco, LLC (“Cricket

Music”) (a wholly-owned subsidiary of Cricket that holds certain hardware, software and intellectual property

relating to Cricket’s Muve Music®service)) for the prior four fiscal quarters.

Borrowings under the Credit Agreement are effectively junior to all of Leap’s, Cricket’s and the guarantors’

obligations under any permitted priority debt that may be incurred in the future (up to the lesser of 0.30 times

Leap’s consolidated cash flow (excluding the consolidated cash flow of STX Wireless and Cricket Music) for the

prior four fiscal quarters and $300 million in aggregate principal amount outstanding), to the extent of the value

of the collateral securing such permitted priority debt, as well as to existing and future liabilities of Leap’s and

Cricket’s subsidiaries that are not guarantors (including STX Wireless and Cricket Music and their respective

subsidiaries). In addition, borrowings under the Credit Agreement are senior in right of payment to any of

Leap’s, Cricket’s and the guarantors’ future subordinated indebtedness.

Cricket has the right to prepay borrowings under the Credit Agreement, in whole or in part, at any time

without premium or penalty, except that prepayments in connection with a repricing transaction occurring on or

prior to October 10, 2013 are subject to a prepayment premium of 1.00% of the principal amount of the

borrowings so prepaid.

110