Cricket Wireless 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

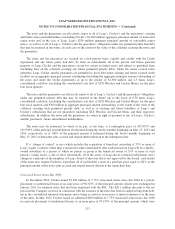

Company’s carrying value that resulted from the transaction. See “Note 6. Significant Acquisitions and Other

Transactions” for additional information on the spectrum swap. As such, the Company was required to perform

an interim goodwill impairment test. In conducting the interim impairment test, the Company determined its fair

value by using the average market capitalization during the month of October, which was selected because that

was the month in which the spectrum swap transaction closed. Consistent with the Company’s annual

impairment test conducted in the third quarter, the Company continued to apply a control premium of 30% to its

average market capitalization. The carrying value of the Company’s goodwill was $31.9 million as of

October 31, 2012. The value of the Company’s net assets as of October 31, 2012 was $528.0 million and the fair

value of the Company, based upon the average market capitalization during the month of October and an

assumed control premium of 30%, was $621.2 million. As such, the Company determined that no impairment

condition existed on an interim basis and the Company was not required to perform the second step of the

goodwill impairment test.

The closing price of Leap common stock was $6.65 on December 31, 2012 and Leap’s market capitalization

was above the Company’s book value as of such date. Since that time, the closing price of Leap common stock

has ranged from a high of $7.05 per share to a low of $5.51 per share. If the price of Leap common stock

continues to trade at or near current levels or certain triggering events were to occur, the Company may be

required to perform the second step of its goodwill impairment test on an interim basis to determine the fair value

of its net assets, which may require the Company to recognize a non-cash impairment charge for some or all of

the $31.9 million carrying value of its goodwill.

Based upon the Company’s annual impairment test conducted during the third quarter of 2011, it was

determined that no impairment condition existed because the book value of the Company’s net assets as of

August 31, 2011 was $676.1 million and the fair value of the Company, based upon its average market

capitalization during the month of August and an assumed control premium of 30%, was $848.4 million.

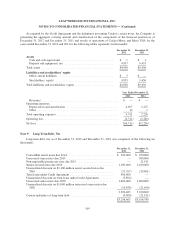

Note 6. Significant Acquisitions and Other Transactions

Other Transactions

On November 26, 2012, the Company entered into an intra-market license exchange agreement with a

subsidiary of T-Mobile USA, Inc., (“T-Mobile”) and Cellco Partnership dba Verizon Wireless (“Verizon

Wireless”) involving various markets in Philadelphia, Wilmington and Atlantic City. Completion of the license

exchange is subject to customary closing conditions, including the consent of the FCC. The wireless licenses to

be transferred under the license exchange agreements have been classified in assets held for sale at their carrying

value of $136.2 million in the consolidated balance sheets as of December 31, 2012.

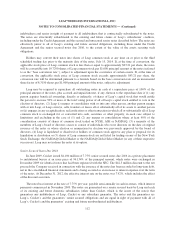

On October 1, 2012, the Company assigned to various entities affiliated with T-Mobile spectrum in various

markets in Alabama, Illinois, Missouri, Minnesota and Wisconsin in exchange for 10 MHz of additional AWS

spectrum in Phoenix, Houston and two other Texas markets. The transactions also included intra-market

exchanges between the Company and T-Mobile in Philadelphia, Wilmington, Atlantic City and various markets

in Texas and New Mexico. The Company recognized a non-cash gain on the transaction of approximately $106.4

million related to the excess of the fair value over carrying value of the spectrum exchanged by the Company in

this transaction.

On August 28, 2012, the Company acquired 12 MHz of 700 MHz A block spectrum in Chicago from

Verizon Wireless for $204 million and the Company and Savary Island sold to Verizon Wireless excess PCS and

AWS spectrum in various markets across the U.S. for $360 million. The Company recognized a net gain of

$130.4 million in connection with these transactions.

104