Cricket Wireless 2012 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LEAP WIRELESS INTERNATIONAL, INC.

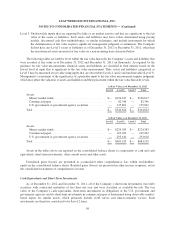

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

borrowings and accrued interest against the purchase price for Pocket’s membership interest, coupled with the

accretion benefit recorded to adjust the redemption value of Pocket’s net interest in STX Wireless, brought the

carrying value of Pocket’s membership interests in STX Wireless to an estimated redemption value of $64.5

million and $90.7 million as of December 31, 2012 and 2011, respectively.

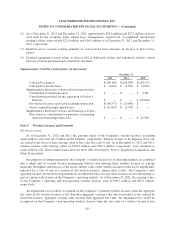

In a separate transaction, on January 3, 2011, the Company acquired Pocket’s customer assistance call

center for $850,000. The Company accounted for this transaction as a business purchase combination in

accordance with the authoritative guidance for business combinations. A portion of the purchase price was

assigned to property and equipment and the remaining amount was allocated to goodwill.

During 2011, the Company completed the integration of Cricket and Pocket operating assets in the South

Texas region to enable the combined network and retail operations of the STX Wireless joint venture to operate

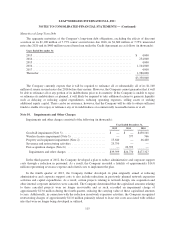

more efficiently. During the year ended December 31, 2011, the Company incurred approximately $26.4 million

of such integration costs, which were recorded in impairments and other charges within the Company’s

consolidated statements of comprehensive income.

Savary Island Venture

Cricket formerly owned an 85% non-controlling membership interest in Savary Island, which held wireless

spectrum in the upper Midwest portion of the U.S. and which leased a portion of that spectrum to us. The

remaining 15% controlling interest was held by Ring Island Wireless, LLC (“Ring Island”). In May 2012, Ring

Island exercised its right to put its entire controlling membership interest in Savary Island to Cricket, and in

October 2012, Cricket acquired Ring Island’s 15% controlling interest for approximately $5.3 million in cash. In

December 2012, Savary Island and its subsidiaries were merged with and into Cricket, with Cricket as the

surviving entity.

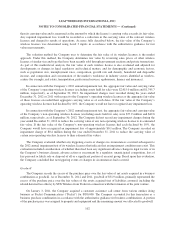

Cricket, Savary Island and Savary Island’s wholly-owned subsidiaries were party to an Amended and

Restated Credit Agreement, dated as of December 27, 2010 (the “Savary Island Credit Agreement”) pursuant to

which Savary Island had assumed approximately $211.6 million of the outstanding loans owed to Cricket by a

subsidiary of Denali Spectrum, LLC (“Denali”) in connection with the contribution of certain wireless spectrum

by a subsidiary of Denali to Savary Island. Under the Savary Island Credit Agreement, Cricket had also agreed to

loan Savary Island up to $5.0 million to fund its working capital needs. Immediately prior to Cricket’s

acquisition of Ring Island’s controlling membership interest in Savary Island, the outstanding borrowings under

the Savary Island Credit Agreement (including accrued interest), after giving effect to various repayments and

debt cancellations made in connection with the closing of spectrum transactions involving Savary Island, totaled

approximately $12.5 million. In connection with Cricket’s acquisition of Ring Island’s controlling membership

interest, all remaining indebtedness under the Savary Island Credit Agreement was converted into equity in

Savary Island and the Savary Island Credit Agreement and all related loan and security documents were

terminated.

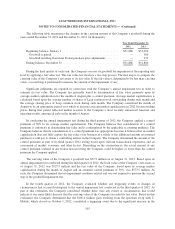

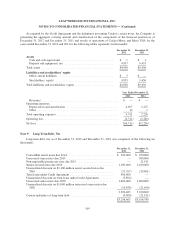

Note 7. Arrangements with Variable Interest Entities and Joint Ventures

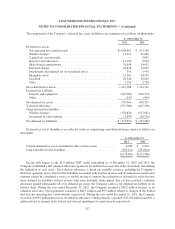

As described in Note 2, the Company consolidates its controlling membership interest in STX Wireless in

accordance with the authoritative guidance for consolidations based on the voting interest model. All

intercompany accounts and transactions have been eliminated in the consolidated financial statements.

Prior to October 1, 2012, the Company consolidated its non-controlling membership interest in Savary

Island in accordance with the authoritative guidance for the consolidation of variable interest entities because

Savary Island was a variable interest entity and, among other factors, the Company had entered into an agreement

with Savary Island’s other member that established a specified purchase price in the event that it exercised its

107