Cricket Wireless 2012 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

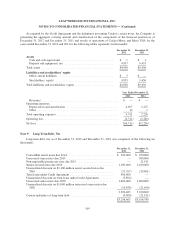

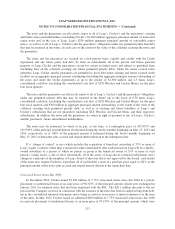

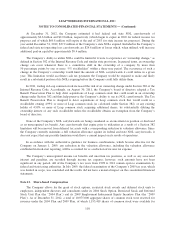

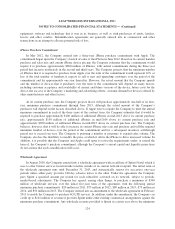

Maturities of Long-Term Debt

The aggregate maturities of the Company’s long-term debt obligations, excluding the effects of discount

accretion on its $1,100 million of 7.75% senior secured notes due 2016, its $1,600 million of 7.75% unsecured

notes due 2020 and its $400 million secured term loan under the Credit Agreement are as follows (in thousands):

Years Ended December 31:

2013 ................................................................... $ 4,000

2014 ................................................................... 254,000

2015 ................................................................... 4,000

2016 ................................................................... 1,104,000

2017 ................................................................... 4,000

Thereafter .............................................................. 1,980,000

$3,350,000

The Company currently expects that it will be required to refinance all or substantially all of its $1,100

million of senior secured notes due 2016 before they mature. However, the Company cannot guarantee that it will

be able to refinance all or any portion of its indebtedness prior to its maturity. If the Company is unable to repay

or refinance its indebtedness as planned, it will likely be required to take additional actions to generate liquidity

such as delaying or reducing capital expenditures, reducing operating expenses, selling assets or seeking

additional equity capital. There can be no assurance, however, that the Company will be able to obtain sufficient

funds to enable it to repay or refinance any of its indebtedness on commercially reasonable terms or at all.

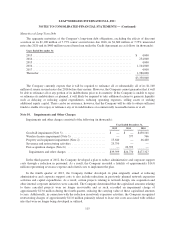

Note 10. Impairments and Other Charges

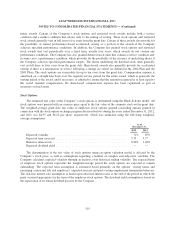

Impairments and other charges consisted of the following (in thousands):

Year Ended December 31,

2012 2011 2010

Goodwill impairment (Note 5) ............................. $ — $ — $430,101

Wireless license impairment (Note 5) ....................... — 377 766

Property and equipment impairment (Note 2) ................. 13,640 — 46,460

Severance and restructuring activities ....................... 25,759 — —

Post-acquisition charges (Note 6) .......................... — 26,393 —

Impairments and other charges .......................... $39,399 $26,770 $477,327

In the third quarter of 2012, the Company developed a plan to reduce administrative and corporate support

costs through a reduction in personnel. As a result, the Company recorded a liability of approximately $14.8

million representing severance expense and related costs to implement the plan.

In the fourth quarter of 2012, the Company further developed its plan originally aimed at reducing

administrative and corporate support costs to also include reductions in previously planned network expansion

activities and capital expenditures. As a result, certain projects relating to network design, site acquisition and

other internal corporate initiatives were canceled. The Company determined that the capitalized amounts relating

to these canceled projects were no longer recoverable and as such, recorded an impairment charge of

approximately $13.6 million during the fourth quarter, reducing the carrying value of these capitalized amounts

to zero. Additionally, in connection with the reduction in network expansion activities, the Company recognized

restructuring charges of approximately $11.0 million primarily related to lease exit costs associated with cellular

sites that were no longer being developed or utilized.

115