Cricket Wireless 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

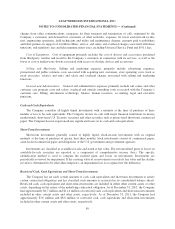

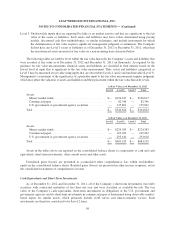

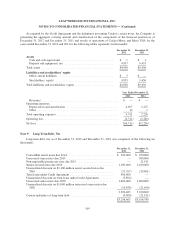

Available-for-sale securities were comprised as follows as of December 31, 2012 and December 31, 2011

(in thousands):

As of December 31, 2012

Cost Fair Value

Money market funds ............................................. $126,617 $126,617

Commercial paper ............................................... 82,345 82,346

U.S. government or government agency securities ...................... 135,848 135,861

$344,810 $344,824

As of December 31, 2011

Cost Fair Value

Money market funds ............................................. $224,383 $224,383

Commercial paper ............................................... 165,201 165,202

U.S. government or government agency securities ...................... 293,626 293,610

$683,210 $683,195

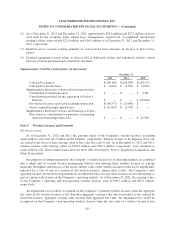

Long-Term Debt

The Company reports its long-term debt obligations at amortized cost; however, for disclosure purposes, the

Company is required to measure the fair value of outstanding debt on a recurring basis. The fair value of the

Company’s outstanding long-term debt is determined primarily by using quoted prices in active markets and was

$3,421.5 million and $3,073.6 million as of December 31, 2012 and 2011, respectively. The Company’s debt was

considered to be a Level 1 item for disclosure purposes.

Assets Measured at Fair Value on a Nonrecurring Basis

As of December 31, 2012, non-financial assets with carrying value of $13.6 million accumulated in

construction-in-progress had been reduced to a fair value of zero, resulting in an impairment charge of $13.6

million. There were no other non-financial assets that were measured and recorded at fair value on a non-

recurring basis. As of December 31, 2011, non-financial assets that were measured and recorded at fair value on

a nonrecurring basis consisted of non-operating wireless licenses in the amount of $9.1 million, the carrying

value of which had been reduced to fair value during the year ended December 31, 2011, resulting in an

impairment charge of $0.4 million. As discussed in Note 5, the Company recorded charges for the impairment of

certain non-operating wireless licenses as of result of its 2011 annual impairment test. The fair value of the

wireless licenses was determined using Level 3 inputs and the valuation techniques discussed therein.

99