Cricket Wireless 2012 Annual Report Download - page 83

Download and view the complete annual report

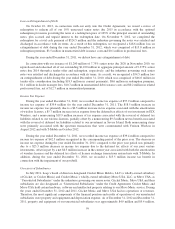

Please find page 83 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net cash provided by financing activities was $386.9 million for the year ended December 31, 2011, which

included the effects of the following transactions during the period:

• We issued $400 million of additional 7.75% senior notes due 2020, which resulted in net proceeds of

$396.8 million.

• We prepaid approximately $23.6 million in principal amount of our non-negotiable promissory note.

• We received proceeds of approximately $25.8 million from the sale lease-back financing related to

certain of our telecommunications towers and related assets.

Net cash used in financing activities was $12.5 million for the year ended December 31, 2010, which

included the effects of the following transactions:

• We issued $1,200 million of 7.75% senior notes due 2020, which resulted in net proceeds of

$1,179.9 million. This note issuance was offset by the payment to repurchase and redeem all of our

$1,100 million of outstanding 9.375% senior notes due 2014.

• We made payments of $24.2 million to acquire all of the remaining membership interests we did not

previously own in LCW Wireless, LLC, or LCW.

• We made payments of $12.1 million to repay and discharge all amounts outstanding under LCW’s former

senior secured credit agreement.

• We made payments of $53.5 million to acquire all of the remaining membership interests we did not

previously own in Denali Spectrum, LLC, or Denali.

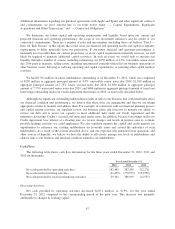

Credit Agreement

On October 10, 2012, Cricket entered into the Credit Agreement with respect to a $400 million senior

secured term loan facility, which was fully drawn at closing and matures in October 2019. Outstanding

borrowings under the Credit Agreement bear interest at the London Interbank Offered Rate, or LIBOR, plus

3.50% (subject to a LIBOR floor of 1.25% per annum) or at the bank base rate plus 2.50% (subject to a base rate

floor of 2.25% per annum), as selected by Cricket. At December 31, 2012, the weighted average effective interest

rate on outstanding borrowings under the Credit Agreement was 4.80%. Borrowings under the Credit Agreement

must be repaid in 27 quarterly installments of $1.0 million each, commencing on March 31, 2013, followed by a

final installment of $373.0 million at maturity. Net proceeds from the term loan facility were used to redeem all

of Cricket’s $300 million in aggregate principal amount of outstanding 10.0% unsecured senior notes due 2015

and for general corporate purposes.

Borrowings under the Credit Agreement are guaranteed by Leap and each of its existing and future wholly

owned domestic subsidiaries (other than Cricket, which is the borrower) that guarantees any indebtedness of

Leap, Cricket or any subsidiary guarantor or that constitutes a “significant subsidiary” as defined in Regulation

S-X under the Securities Act of 1933, as amended (subject to certain exceptions).

Borrowings under the Credit Agreement are effectively senior to all of Leap’s, Cricket’s and the guarantors’

existing and future unsecured indebtedness (including Cricket’s $1,600 million aggregate principal amount of

unsecured senior notes and, in the case of Leap, Leap’s $250 million aggregate principal amount of convertible

senior notes), as well as to all of Leap’s, Cricket’s and the guarantors’ obligations under any permitted junior lien

debt that may be incurred in the future, in each case to the extent of the value of the collateral securing the

obligations under the Credit Agreement.

Borrowings under the Credit Agreement are secured on a first-priority basis, equally and ratably with

Cricket’s 7.75% senior secured notes due 2016 and any future parity lien debt, by liens on substantially all of the

present and future personal property of Leap, Cricket and the guarantors, except for certain excluded assets and

subject to permitted liens (including liens on the collateral securing any future permitted priority debt). Under the

69