Cricket Wireless 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.change in a majority of the members of Leap’s board of directors that is not approved by the board), each holder

of the notes may require Cricket to repurchase all of such holder’s notes at a purchase price equal to 101% of the

principal amount of the notes, plus accrued and unpaid interest, if any, thereon to the repurchase date.

The indenture governing the notes limits, among other things, our ability to: incur additional debt; create

liens or other encumbrances; place limitations on distributions from restricted subsidiaries; pay dividends; make

investments; prepay subordinated indebtedness or make other restricted payments; issue or sell capital stock of

restricted subsidiaries; issue guarantees; sell assets; enter into transactions with our affiliates; and make

acquisitions or merge or consolidate with another entity.

Fair Value of Financial Instruments and Non-Financial Assets

As more fully described in Note 4 to our consolidated financial statements included in “Part II — Item 8.

Financial Statements and Supplementary Data” of this report, we apply the authoritative guidance for fair value

measurements to our assets and liabilities. The guidance defines fair value as an exit price, which is the price that

would be received upon the sale of an asset or paid upon the transfer of a liability in an orderly transaction

between market participants at the measurement date. The degree of judgment utilized in measuring the fair

value of assets and liabilities generally correlates to the level of pricing observability. Assets and liabilities with

readily available, actively quoted prices or for which fair value can be measured from actively quoted prices in

active markets generally have more pricing observability and require less judgment in measuring fair value.

Conversely, assets and liabilities that are rarely traded or not quoted have less pricing observability and are

generally measured at fair value using valuation models that require more judgment. These valuation techniques

involve some level of management estimation and judgment, the degree of which is dependent on the price

transparency of the asset, liability or market and the nature of the asset or liability.

We have categorized our assets and liabilities measured at fair value into a three-level hierarchy in

accordance with the authoritative guidance for fair value measurements. Assets and liabilities measured at fair

value using quoted prices in active markets for identical assets or liabilities are generally categorized as Level 1;

assets and liabilities measured at fair value using observable market-based inputs or unobservable inputs that are

corroborated by market data for similar assets or liabilities are generally categorized as Level 2; and assets and

liabilities measured at fair value using unobservable inputs that cannot be corroborated by market data are

generally categorized as Level 3. Such Level 3 assets and liabilities have values determined using pricing

models, discounted cash flow methodologies, or similar techniques, and include instruments for which the

determination of fair value requires significant management judgment and estimation. As of December 31, 2012

and December 31, 2011, none of our financial assets required fair value to be measured using Level 3 inputs.

However, as more fully described in Note 4 to our consolidated financial statements included in “Item 8.

Financial Statements and Supplementary Data” of this report, we have non-financial assets measured at fair value

using Level 3 inputs on a non-recurring basis.

Generally, our results of operations are not significantly impacted by our assets and liabilities accounted for

at fair value due to the nature of each asset and liability.

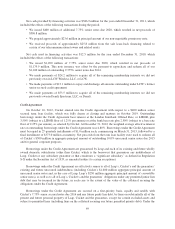

We continue to report our long-term debt obligations at amortized cost and disclose the fair value of such

obligations.

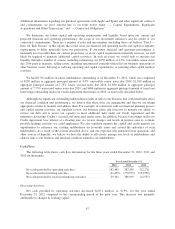

Capital Expenditures, Significant Acquisitions and Other Transactions

Capital Expenditures

During the year ended December 31, 2012, we incurred approximately $434.4 million in capital

expenditures. These capital expenditures were primarily for the ongoing maintenance and development of our

network and other business assets and the initial deployment of next-generation LTE network technology.

74