Cricket Wireless 2012 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

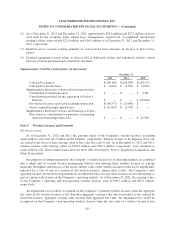

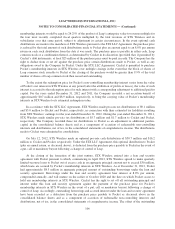

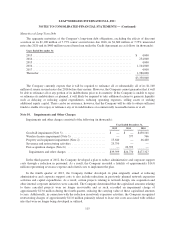

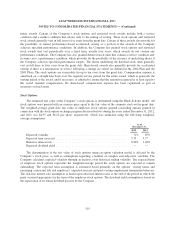

As required by the Credit Agreement and the indentures governing Cricket’s senior notes, the Company is

presenting the aggregate carrying amount and classification of the components of the financial position as of

December 31, 2012 and December 31, 2011 and results of operations of Cricket Music and Muve USA for the

years ended December 31, 2012 and 2011 in the following tables separately (in thousands):

December 31,

2012

December 31,

2011

Assets

Cash and cash equivalents ................................... $ 1 $ 1

Property and equipment, net ................................. 4,937 9,435

Total assets ................................................. $4,938 $9,436

Liabilities and stockholders’ equity

Other current liabilities ..................................... $ 5 $ —

Stockholders’ equity ....................................... 4,933 9,436

Total liabilities and stockholders’ equity .......................... $4,938 $9,436

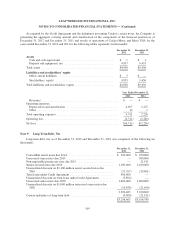

Year Ended December 31,

2012 2011

Revenues .................................................... $ — $ —

Operating expenses:

Depreciation and amortization ................................... 4,497 2,225

Other ....................................................... 14 1

Total operating expenses .......................................... 4,511 2,226

Operating loss .................................................. (4,511) (2,226)

Net loss ....................................................... $(4,511) $(2,226)

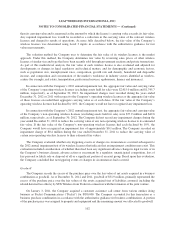

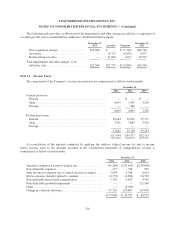

Note 9. Long-Term Debt, Net

Long-term debt, net as of December 31, 2012 and December 31, 2011 was comprised of the following (in

thousands):

December 31,

2012

December 31,

2011

Convertible senior notes due 2014 ............................... $ 250,000 $ 250,000

Unsecured senior notes due 2015 ............................... — 300,000

Non-negotiable promissory note due 2015 ........................ — 21,911

Senior secured notes due 2016 .................................. 1,100,000 1,100,000

Unamortized discount on $1,100 million senior secured notes due

2016 .................................................... (23,767) (29,601)

Term loans under Credit Agreement ............................. 400,000 —

Unamortized discount on term loans under Credit Agreement ......... (3,892) —

Unsecured senior notes due 2020 ............................... 1,600,000 1,600,000

Unamortized discount on $1,600 million unsecured senior notes due

2020 .................................................... (19,878) (21,650)

3,302,463 3,220,660

Current maturities of long-term debt ............................. (4,000) (21,911)

$3,298,463 $3,198,749

109