Cricket Wireless 2012 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

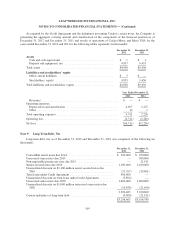

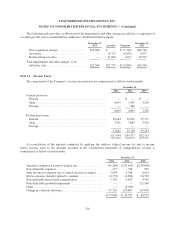

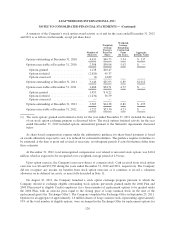

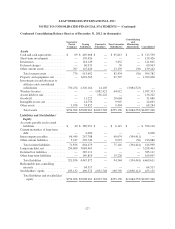

The components of the Company’s deferred tax assets (liabilities) are summarized as follows (in thousands):

As of December 31,

2012 2011

Deferred tax assets:

Net operating loss carryforwards .............................. $1,008,492 $ 973,560

Wireless licenses ........................................... 13,291 21,046

Capital loss carryforwards .................................... — 3,031

Reserves and allowances ..................................... 13,990 8,818

Share-based compensation ................................... 29,698 34,631

Deferred charges ........................................... 49,898 53,835

Investments and deferred tax on unrealized losses ................. 395 5,478

Intangible assets ........................................... 15,502 18,545

Goodwill ................................................. 28,546 30,869

Other .................................................... 2,156 2,328

Gross deferred tax assets ....................................... 1,161,968 1,152,141

Deferred tax liabilities:

Property and equipment ..................................... (222,260) (302,373)

Other .................................................... (242) (439)

Net deferred tax assets ......................................... 939,466 849,329

Valuation allowance .......................................... (937,568) (847,399)

Other deferred tax liabilities:

Wireless licenses ........................................... (378,876) (317,682)

Investment in joint ventures .................................. (1,653) (10,236)

Net deferred tax liabilities ...................................... $ (378,631) $ (325,988)

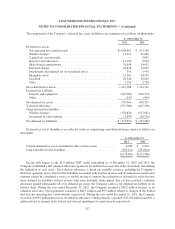

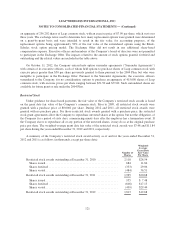

Deferred tax assets (liabilities) are reflected in the accompanying consolidated balance sheets as follows (in

thousands):

As of December 31,

2012 2011

Current deferred tax assets (included in other current assets) ............ 6,480 $ 7,816

Long-term deferred tax liabilities .................................. (385,111) (333,804)

$(378,631) $(325,988)

Except with respect to the $1.9 million TMT credit outstanding as of December 31, 2012 and 2011, the

Company established a full valuation allowance against its net deferred tax assets due to the uncertainty surrounding

the realization of such assets. The valuation allowance is based on available evidence, including the Company’s

historical operating losses. Deferred tax liabilities associated with wireless licenses and investments in certain joint

ventures cannot be considered a source of taxable income to support the realization of deferred tax assets because

these deferred tax liabilities will not reverse until some indefinite future period. Since it has recorded a valuation

allowance against substantially all of its deferred tax assets, the Company carries a net deferred tax liability on its

balance sheet. During the year ended December 31, 2012, the Company recorded a $90.2 million increase to its

valuation allowance, which primarily consisted of $84.3 million and $5.9 million related to changes in the federal

and state net operating loss carryforwards, respectively. During the year ended December 31, 2011, the Company

recorded a $138.9 million increase to its valuation allowance, which primarily consisted of $124.6 million and $11.1

million related to changes in the federal and state net operating loss carryforwards, respectively.

117