Cricket Wireless 2012 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

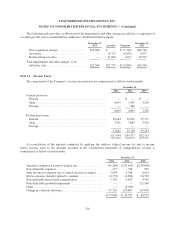

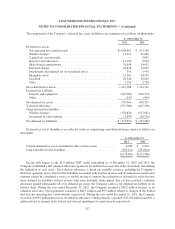

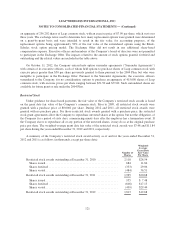

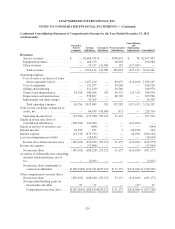

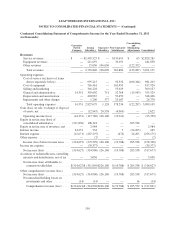

A summary of the Company’s stock option award activity as of and for the years ended December 31, 2012

and 2011 is as follows (in thousands, except per share data):

Number of

Shares(1)

Weighted-

Average

Exercise

Price Per

Share

Weighted-

Average

Remaining

Contractual

Term

(In Years)

Aggregate

Intrinsic Value

Options outstanding at December 31, 2010 . . . 4,631 $40.73 5.94 $ 137

Options exercisable at December 31, 2010 .... 2,308 $38.98 5.07 $ —

Options granted ....................... 1,138 $10.47

Options forfeited ...................... (2,620) 45.37

Options exercised ..................... (2) 14.89

Options outstanding at December 31, 2011 . . . 3,146 $25.93 6.89 $1,012

Options exercisable at December 31, 2011 .... 1,466 $34.71 4.79 $ —

Options granted ....................... 1,453 $ 8.22

Options forfeited ...................... (1,234) 36.59

Options exercised ..................... — —

Options outstanding at December 31, 2012 . . . 3,365 $14.38 6.82 $ 433

Options exercisable at December 31, 2012 .... 1,222 $23.30 4.23 $ —

(1) The stock options granted and forfeited activity for the year ended December 31, 2011 included the impact

of our stock option exchange program as discussed below. The stock options forfeited activity for the year

ended December 31, 2012 included options surrendered pursuant to the Surrender Agreements discussed

below.

As share-based compensation expense under the authoritative guidance for share-based payments is based

on awards ultimately expected to vest, it is reduced for estimated forfeitures. The guidance requires forfeitures to

be estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from

those estimates.

At December 31, 2012, total unrecognized compensation cost related to unvested stock options was $10.4

million, which is expected to be recognized over a weighted-average period of 2.9 years.

Upon option exercise, the Company issues new shares of common stock. Cash received from stock option

exercises was $0 and $32,730 during the years ended December 31, 2012 and 2011, respectively. The Company

did not recognize any income tax benefits from stock option exercises as it continues to record a valuation

allowance on its deferred tax assets, as more fully described in Note 11.

On August 10, 2011, the Company launched a stock option exchange program pursuant to which the

Company offered to exchange eligible outstanding stock options previously granted under the 2004 Plan and

2009 Plan issued to eligible Cricket employees for a lesser number of replacement options to be granted under

the 2004 Plan, with an exercise price equal to the closing price of Leap common stock on the date of the

replacement grant (the “Exchange Offer”). The Company completed the Exchange Offer on September 23, 2011.

Options for an aggregate of approximately 1.6 million shares of Leap common stock, representing approximately

93% of the total number of eligible options, were exchanged in the Exchange Offer for replacement options for

120