Cricket Wireless 2012 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2012 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

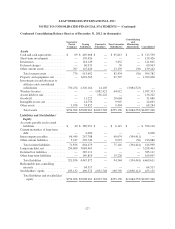

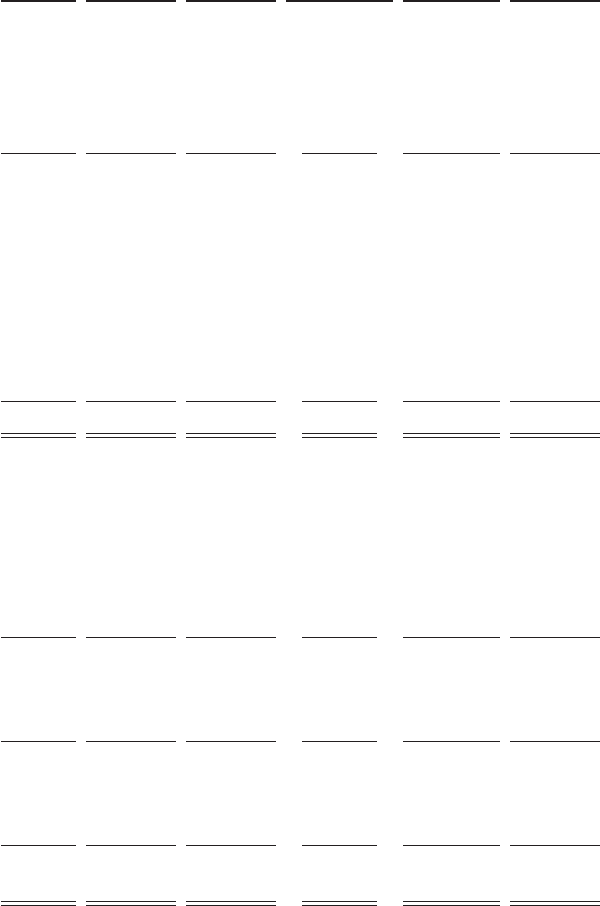

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

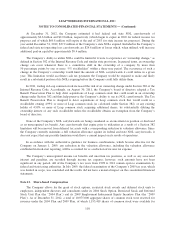

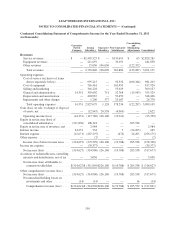

Condensed Consolidating Balance Sheet as of December 31, 2011 (in thousands):

Guarantor

Parent

Company

Issuing

Subsidiary

Guarantor

Subsidiary

Non-Guarantor

Subsidiaries

Consolidating

and

Eliminating

Adjustments Consolidated

Assets

Cash and cash equivalents ......... $ 91 $ 270,055 $ — $ 75,097 $ — $ 345,243

Short-term investments ........... — 405,801 — — — 405,801

Inventories ..................... — 110,710 — 6,247 — 116,957

Deferred charges ................ — 57,936 — 43 — 57,979

Other current assets .............. 2,279 131,330 — 848 — 134,457

Total current assets ............ 2,370 975,832 — 82,235 — 1,060,437

Property and equipment, net ....... — 1,876,031 — 81,343 — 1,957,374

Investments in and advances to

affiliates and consolidated

subsidiaries .................. 918,386 2,241,941 27,863 — (3,188,190) —

Wireless licenses ................ — — 1,724,058 64,912 — 1,788,970

Assets held for sale .............. — — 204,256 — — 204,256

Goodwill ...................... — 11,222 — 20,664 — 31,886

Intangible assets, net ............. — 17,418 — 24,059 — 41,477

Other assets .................... 3,894 59,592 — 4,804 — 68,290

Total assets .................. $924,650 $5,182,036 $1,956,177 $278,017 $(3,188,190) $5,152,690

Liabilities and Stockholders’

Equity

Accounts payable and accrued

liabilities .................... $ 79 $ 447,298 $ — $ 12,901 $ — $ 460,278

Current maturities of long-term

debt ........................ — 21,911 — — — 21,911

Intercompany payables ........... 56,009 281,546 — 32,811 (370,366) —

Other current liabilities ........... 5,247 247,135 — 11,358 — 263,740

Total current liabilities ......... 61,335 997,890 — 57,070 (370,366) 745,929

Long-term debt, net .............. 250,000 2,948,749 — — — 3,198,749

Deferred tax liabilities ............ — 333,804 — — — 333,804

Other long-term liabilities ......... — 140,979 — 24,004 — 164,983

Total liabilities ................ 311,335 4,421,422 — 81,074 (370,366) 4,443,465

Redeemable non-controlling

interests ..................... — 95,910 — — — 95,910

Stockholders’ equity ............. 613,315 664,704 1,956,177 196,943 (2,817,824) 613,315

Total liabilities and stockholders’

equity ..................... $924,650 $5,182,036 $1,956,177 $278,017 $(3,188,190) $5,152,690

128